- USD/JPY forms a bearish candlestick pattern at the multi-year highs.

- A bearish close on Friday would enhance the possibilities of a pullback.

- The BoJ has historically intervened to strengthen JPY in the 151.000s, indicating more downside pressure likely.

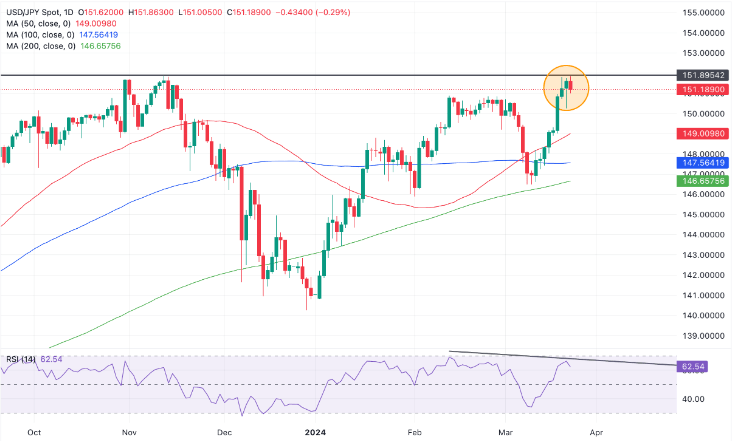

On Friday, USD/JPY encountered a critical chart peak in the 151.000s, marked by the emergence of a bearish Hanging Man Japanese candlestick pattern (highlighted). This formation signals an increased likelihood of a short-term reversal and subsequent pullback in the market.

The pair’s recent test of the 2023 high, coupled with the formation of the bearish candlestick pattern, underscores the likelihood of a subsequent decline. Confirmation of this scenario hinges on Friday’s closure, particularly if it manifests as a bearish red candlestick, reinforcing Thursday’s Hanging Man formation and amplifying the prospects for further downside movement.

While Japanese candlestick patterns typically signal short-term reversals, the potential retreat might be temporary. Compounding this sentiment is the historical tendency for the Bank of Japan (BoJ) to intervene in the 151.000s zone to bolster the Yen, thereby heightening the possibility of imminent weakness in the pair.

Should a pullback materialize, the 50-day Simple Moving Average (SMA) support at 149.009 could serve as a plausible target. Conversely, a resurgence accompanied by a decisive breach above 152.000 would indicate continued bullish momentum, potentially reflecting the BoJ’s hesitancy or limitations in intervening to influence the exchange rate.

However, such an upward move might encounter resistance given prevailing market dynamics, with a prospective target around the next psychological level at 153.000.