- USD/JPY rebounds into a key resistance zone after the release of stickier-than-expected US CPI data.

- The pair has hit a tough ceiling where two major moving averages converge.

- USD/JPY is at risk of rolling over and continuing its short-term downtrend.

Following the release of February’s US Consumer Price Index (CPI) data, USD/JPY experienced a rebound, propelled by the unexpected increase in CPI figures. This surge in inflation raises the likelihood of the Federal Reserve maintaining interest rates at their current elevated levels for an extended period. Historically, higher interest rates tend to attract more capital inflows, thereby bolstering the currency’s strength.

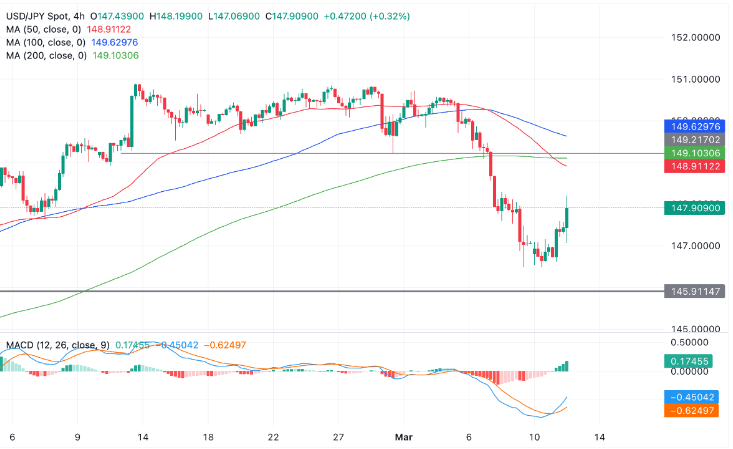

As USD/JPY rallied post-data, it encountered a formidable barrier formed by two significant moving averages: the 50-day (red) and 100-day (blue) Simple Moving Averages (SMA). With the prevailing short-term trend leaning bearish and seemingly unchanged, the ensuing pullback presents an opportune moment for traders to consider short positions on the currency pair.

Impact of CPI on US Dollar could be temporary

Despite the US Consumer Price Index (CPI) data surpassing expectations, much of the upward movement was driven by higher gasoline prices, which are viewed as a transient inflationary factor. Consequently, the potential for sustained and significant appreciation of the US Dollar (USD) – and consequently the USD/JPY pair – is limited and likely to be short-lived.

On the flip side, the Japanese Yen is underpinned by speculation and rumors suggesting that the Bank of Japan (BoJ) might soon raise its base interest rates from negative territory. There’s even speculation that Japan could be on the verge of breaking free from the stagnant growth patterns of the past three decades. This narrative has largely contributed to the recent decline of the USD/JPY pair.

Although the USD/JPY pair continues its short-term downtrend, recent days have seen a pullback, rendering it susceptible to a potential reversal and subsequent decline.

On the 4-hour chart, there are currently no definitive signs indicating the conclusion of the upward correction. Therefore, it remains premature to ascertain whether the pair will resume its downward trajectory. Traders await the formation of a candlestick reversal pattern, which has yet to materialize.

In the event of a reversal lower, the pair is likely to retreat towards the March 8 lows at 146.48. A breach of this level could pave the way for further downside movement, with potential support zones lying at 146.22 and the 200-day SMA, followed by 145.89, the low of February 1st.