- USD/JPY trades lacklustre near 147.50 ahead of US PPI, Retail Sales data.

- The US bond yields drop amid improved market sentiment.

- The uncertainty over BoJ quitting negative rates deepens.

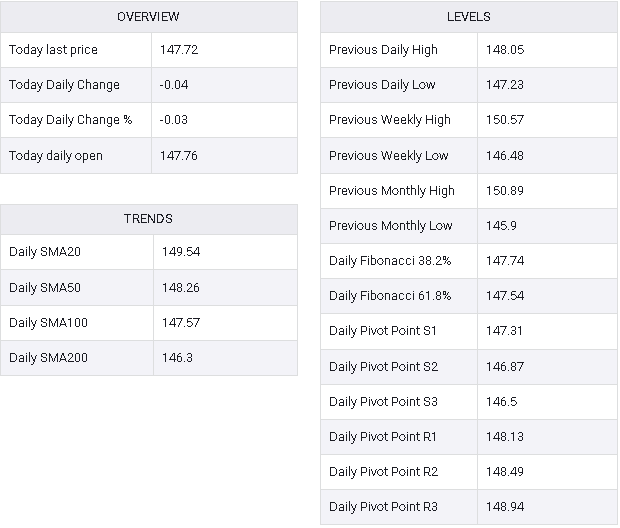

During Thursday’s European session, the USD/JPY pair is in a tight consolidation phase near 147.70. Investors are cautious, awaiting the release of crucial economic data from the United States, specifically the Producer Price Index (PPI) and Retail Sales figures for February, due at 12:30 GMT. These data points are anticipated to offer insights into inflation trends, potentially influencing interest rate expectations.

Projections suggest a 0.8% growth in monthly Retail Sales, rebounding from the equivalent decline in January. Strong demand for automobiles and increased sales at gasoline stations are believed to be driving factors behind this uptick. A positive outcome in Retail Sales could diminish expectations of a rate cut by the Federal Reserve during its June policy meeting.

Presently, the CME FedWatch tool indicates a 69% likelihood of a rate cut announcement in June. However, for the March and May policy meetings, the Fed is anticipated to maintain interest rates within the range of 5.25% to 5.50%.

In the London session, S&P 500 futures are showing notable gains, signaling heightened risk appetite among investors. Conversely, the 10-year US Treasury yields have retraced entirely, hovering around 4.19%. The US Dollar Index (DXY) remains relatively stable near 102.80 ahead of the US economic data release.

Meanwhile, the Japanese Yen continues to face downward pressure amid speculations that the Bank of Japan (BoJ) might postpone plans to exit negative interest rates. BoJ’s Ueda recently noted some signs of economic recovery, albeit with lingering weaknesses in consumption. Finance Minister Shunichi Suzuki separately emphasized that Japan has not yet overcome deflationary challenges.

USD/JPY