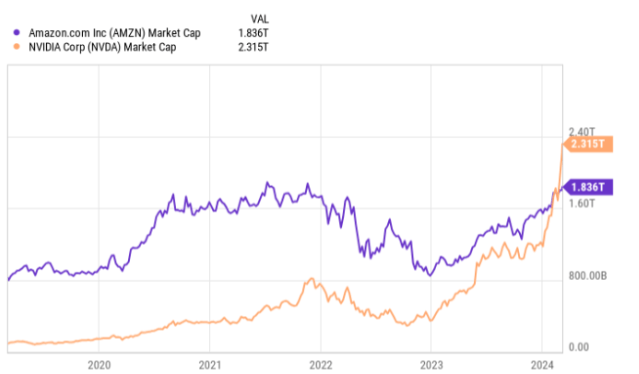

The S&P 500 recently achieved yet another milestone by reaching a new record high, fueled in part by the persistent growth of artificial intelligence (AI) and the remarkable ascent of Nvidia (NASDAQ: NVDA) stock. With Nvidia’s stock price surging, the company now accounts for 5% of the index, and its market capitalization has soared past the $2 trillion threshold. This remarkable feat places Nvidia’s value above that of Amazon (NASDAQ: AMZN) for the first time, as illustrated below.

Nvidia could continue the charge higher. It’s a tremendous company (albeit an expensive stock). But investors shouldn’t overlook Amazon. Here are my four top reasons why Amazon stock is worth buying like there is no tomorrow.

1. AWS is seeing a resurgence

Last year saw considerable concern arise as Amazon Web Services (AWS) experienced a slowdown in growth, reaching 13% compared to the robust 29% in 2022 and 37% in 2021. Despite surpassing $90 billion in revenue for the year, speculation emerged suggesting that the era of rapid cloud computing expansion had come to an end. However, such notions are premature, and I anticipate growth to regain momentum this year.

In 2023, dwindling data usage budgets posed a significant challenge. Businesses braced themselves for a potential recession that ultimately didn’t materialize, prompting Amazon to actively assist its customers in reducing their data usage costs. As concerns about a recession subside, it’s likely that budgets will loosen this year. Furthermore, as this previous hurdle diminishes, a new source of momentum emerges. Given that much of AWS’ sales operate on a usage-based model akin to a utility, the emergence of generative artificial intelligence (AI) software is poised to stimulate growth due to its substantial data requirements.

This year, investors and analysts will closely monitor AWS’s performance. A resurgence in growth could serve as a significant catalyst for the stock’s trajectory.

2. Amazon’s free cash flow is back

The economic stimulus measures implemented during the peak of the pandemic propelled Amazon’s free cash flow to unprecedented highs. However, in 2022, the company faced numerous challenges that led to a significant downturn in free cash flow. Issues such as port congestion, labor shortages, and record-high inflation all contributed to increased costs.

Furthermore, Amazon Web Services (AWS) encountered challenges stemming from its own rapid expansion. The substantial growth necessitated significant investments in equipment (CapEx). Over the span of 2021 and 2022, Amazon allocated a combined $125 billion towards CapEx, a substantial increase from the $57 billion spent in 2020 and 2021. This surge in investment represented a considerable outlay of cash, even for a company of Amazon’s scale.

However, by 2023, many of these challenges had been resolved, leading to a resurgence in free cash flow, as illustrated below.

Amazon will surely use the cash to invest in growth, but it could also institute a share buyback program if it chooses.

3. Amazon’s advertising segment impresses

One of Amazon’s most rapidly expanding revenue streams revolves around online advertising, encompassing product placement, pay-per-click, and video advertisements. Advertisers are keen to secure these placements due to the assurance that their ads are reaching customers actively engaged in purchasing. Like many, I tend to focus on the first page of search results, a behavior well recognized by sellers. This has propelled advertising sales to soar, surging from $13 billion in 2019 to an impressive $46 billion in 2023.

Remarkably, this marked the first instance where ad sales surpassed Prime subscription revenue, amounting to $47 billion compared to $40 billion, respectively. With budgets expected to loosen in 2024, this segment is poised for further growth. It stands as yet another formidable revenue stream for Amazon, bolstering its overall financial performance.

4. Consumer sentiment is on the upswing

I, like many others, anticipated that rising interest rates and the gradual reduction of economic stimulus would dampen consumer spending. However, contrary to these expectations, there are scant indications of consumers scaling back. In fact, consumer sentiment, widely regarded as the key precursor to consumer spending, continues to ascend steadily, as depicted below.

While the current consumer sentiment figure remains below pre-pandemic levels, its impressive climb amid declining inflation is noteworthy. This trend bodes well for Amazon’s e-commerce business, as consumer spending plays a pivotal role in its success. On the inflation front, the decrease to 3.2% indicates that the Federal Reserve’s interest rate hikes are effectively curbing inflation, signaling ongoing economic growth. While challenges persist, the overall trajectory appears promising.

Despite Amazon’s significant stock price increase over the past year, it still trades at a discount relative to its 5-year averages based on sales and operating cash flow. Coupled with the favorable tailwinds mentioned above, Amazon presents an attractive opportunity for long-term investment.

However, before diving into Amazon stock, it’s important to consider that The Motley Fool Stock Advisor analyst team recently identified what they believe to be the 10 best stocks for investors to buy now, with Amazon not making the cut. These selected stocks hold the potential for substantial returns in the years ahead.

Stock Advisor offers investors a comprehensive strategy for success, including portfolio building guidance, regular analyst updates, and two new stock recommendations each month. Since its inception in 2002, Stock Advisor has significantly outperformed the S&P 500*.