Renowned activist investor Carl Icahn is celebrated globally for his knack for identifying undervalued companies and advocating for strategic changes that enhance their value.

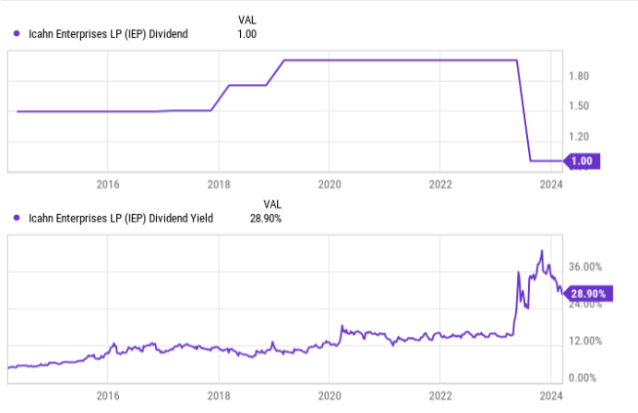

An astonishing 57% of Icahn’s investment portfolio is allocated to a single stock: Icahn Enterprises (NASDAQ: IEP). While the stock boasts an impressive dividend yield nearing 29%, it has weathered substantial scrutiny over the past year. Consequently, its price has plummeted by 66% since May 2023.

Despite the allure of Icahn Enterprises’ enticing dividend, potential investors should carefully evaluate several factors before considering investment in the stock

Carl Icahn’s investing approach

Carl Icahn has built an illustrious track record of investment success, employing a value-driven approach akin to that of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett. Despite their shared value-oriented strategies, there are notable distinctions in their investment styles.

Buffett typically adopts a hands-off approach after acquiring shares in a company through Berkshire Hathaway. He entrusts the management teams of these companies to operate independently, without his direct intervention or continual oversight. Buffett’s long-term perspective guides his investments, leading him to back management teams he believes capable of effectively steering the business.

In contrast, Icahn assumes an active role in reshaping management teams and implementing strategic changes he deems necessary to revitalize businesses. As one of the pioneers of activist investing, Icahn has earned the moniker “corporate raider.” One of his notable successes occurred in 2014, when he acquired a stake in eBay and advocated for the spin-off of PayPal. This move resulted in remarkable returns for investors in the subsequent years.

Evaluating Icahn Enterprises’ business performance

Icahn primarily conducts his activist investing endeavors within the investment segment of Icahn Enterprises. Here, his objective is to identify undervalued companies and enhance their valuations through cost reduction or strategic acquisitions aimed at improving efficiency.

As of the end of last year, investments in this segment were valued at $3.2 billion and comprised both long and short positions. Notable holdings include Crown Holdings, Southwest Gas Holdings, Illumina, and Bausch Health Companies. However, Icahn’s investment segment encountered significant challenges over the past five years, resulting in a loss of $2.3 billion.

One factor contributing to the segment’s underperformance was Icahn’s extensive short-selling activities. In recent years, he has taken substantial short positions, including credit default swaps (CDSs) utilized for shorting commercial mortgage-backed securities.

In a 2023 letter addressed to unitholders, Icahn acknowledged that his team had deviated from their activist methodology by engaging in excessive short-selling activities. He emphasized their intention to refocus on their activist strategy while maintaining appropriate hedging measures moving forward.

Apart from its investment activities, Icahn Enterprises also maintains controlling interests in various companies across the energy, automotive, food packaging, and real estate sectors. Notably, its most significant holding is in CVR Energy, where it possesses a 66% stake in the company’s outstanding stock. CVR Energy is primarily involved in petroleum refining and marketing, as well as nitrogen fertilizer manufacturing. Over the years, CVR Energy has proven to be one of the more successful holdings within Icahn Enterprises’ portfolio.

Icahn stock has become a target of short-sellers

Icahn Enterprises has experienced a notable decline over the past year, partly attributed to a report from the renowned short-seller Hindenburg Research. According to Hindenburg’s report, allegations were made regarding the overstatement of Icahn Enterprises’ net asset value (NAV).

Hindenburg further contended that at the time of the report, Icahn Enterprises traded at a 218% premium to its net asset value (NAV), largely driven by retail investors drawn to its high dividend payout and the allure of investing alongside the legendary activist investor. The report also raised concerns about the company’s cash flow being insufficient to sustain its distribution.

Is Icahn Enterprises stock a buy?

Icahn Enterprises presents an attractive dividend yield, which may appeal to income-oriented investors. Carl Icahn’s assertion that the company is reverting to its activist investor origins suggests a potential turnaround in its investment performance, which has been a hindrance to the business for an extended period.

However, despite these optimistic outlooks, there are noteworthy challenges ahead. The company’s debt-to-equity ratio surged notably last year, raising concerns about its financial stability. Additionally, its dividend is susceptible to further reductions, indicating vulnerability in its income stream.

Therefore, given these factors, I would advise against purchasing the stock at the present time.