With Enterprise Products Partners’ (NYSE: EPD) units having increased by approximately 10% in 2024, some investors might be concerned about missing out on the chance to acquire this high-yield midstream giant. However, the simple response is no: There remain numerous compelling reasons to consider investing in this master limited partnership (MLP) with its substantial 7% distribution yield. Here’s what you should be aware of.

Enterprise moves oil, it doesn’t drill for it

One of the key aspects to grasp about Enterprise Products Partners is its operation in the midstream sector. This encompasses crucial energy infrastructure assets such as pipelines, storage facilities, transportation networks, and processing plants. Midstream companies play a pivotal role in linking the upstream sector (drilling) with the downstream sector (refining and chemicals), facilitating connectivity both domestically and globally.

The core of the midstream sector hinges on its primarily toll-based structure. Essentially, Enterprise Products Partners generates revenue from the usage of its vital assets. While the prices of commodities passing through its infrastructure matter, their impact on the MLP’s financial performance is overshadowed by the enduring demand for energy. This demand tends to remain strong regardless of fluctuations in oil, natural gas, and related commodity prices.

The steady dynamics within the midstream sector consistently produce cash flows, bolstering Enterprise’s enticing 7% distribution yield. Though slightly lower than its previous level when unit prices were 10% lower, it still exceeds the yields offered by an S&P 500 index fund (1.3%) or the average energy stock (2.9%), with the Vanguard Energy Index ETF serving as a benchmark for the industry.

The key message remains consistent: Even with significant price appreciation, Enterprise remains an attractive investment option focused on income.

Enterprise’s distribution should keep growing

However, despite Enterprise’s distribution yield being slightly less enticing compared to when unit prices were lower, there are still compelling reasons to consider investing in it.

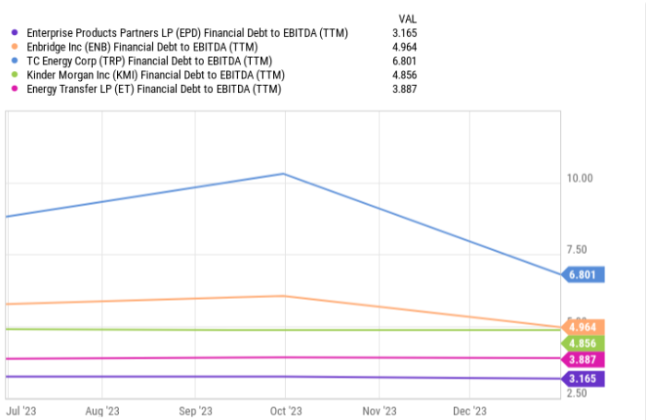

One such reason is its exceptionally robust balance sheet, which stands out in the midstream sector. Not only does the MLP boast an investment-grade rating, but its debt-to-EBITDA ratio of 3.1 times is also lower than that of any of its nearest competitors. This indicates a solid financial footing and reinforces its position as a stalwart in the industry.

The distribution track record of Enterprise is impressive, having increased payments annually for 25 consecutive years, a testament to their commitment to unitholders. In 2023, the MLP’s distributable cash flow comfortably covered the distribution by 1.7 times, indicating a robust financial position. It would take significant setbacks for the distribution to be in jeopardy.

Moreover, there are solid reasons to anticipate further distribution growth. The consistent pattern of annual increases reflects a dedicated strategy. Additionally, Enterprise benefits from built-in price escalations in its contracts.

Furthermore, the completion of $6.8 billion in capital investment projects, scheduled until 2026, promises to bolster cash flows. Historical trends suggest that as current projects conclude, new ones will likely emerge. With its size and financial strength, Enterprise also stands poised to pursue industry consolidation opportunities.

You are buying Enterprise for the yield

While it’s true that this MLP operates in a relatively mundane sector, its appeal lies in its focus on generating consistent yields for investors. Enterprise Products Partners prioritizes providing a steady income stream.

Considering that its yield remains notably attractive compared to alternative investments, coupled with the company’s financial robustness and the steady growth projected from its ongoing capital investment projects, income-oriented investors should remain confident in purchasing even after its recent 10% price increase.