Fueled by a rising demand for servers to support artificial intelligence (AI) applications, Super Micro Computer (NASDAQ: SMCI) has emerged as one of the market’s standout performers. The specialist in high-performance servers has seen its share price surge nearly 300% in 2024 alone, marking an astonishing 1000% increase over the past year. The latest boost came with the news of its inclusion in the S&P 500 index.

While the company’s business performance has experienced a significant uptick, the remarkable gains in its stock inevitably raise questions about its valuation. Investors may wonder if it’s too late to join the rally in this dynamic AI stock or if there’s potential for even more substantial returns ahead.

What’s powering Supermicro’s massive stock gains?

The surge in AI stocks is evident, with Supermicro (commonly known as Super Micro Computer, NASDAQ: SMCI) benefiting significantly from Nvidia’s robust business performance. Leveraging Nvidia’s graphics processing units (GPUs) in its high-performance rack servers, Supermicro’s valuation has been positively influenced by the excitement surrounding the GPU leader. However, attributing the valuation gains solely to hype would be a misconception.

Supermicro has strategically positioned itself as a comprehensive provider of AI server solutions, carving out a valuable niche in the current landscape. The company’s technologies play a pivotal role in processing and distributing information for software applications, experiencing heightened demand for its high-performance rack servers in tandem with the accelerating adoption of AI applications.

In the second quarter of its fiscal year 2024, concluding on December 31, Supermicro reported robust sales of $3.66 billion, marking a remarkable 103% year-over-year increase in revenue. Additionally, non-GAAP (adjusted) earnings per share witnessed a substantial 71.5% year-over-year growth, reaching $5.59 per share.

The ascendancy of AI has propelled Supermicro into a new phase of growth, prompting the question of how long this cycle will persist and whether the company’s valuations have reached unreasonable levels.

Strong growth is poised to continue in the near term

In the current quarter, Supermicro anticipates sales in the range of $3.7 billion to $4.1 billion, indicating year-over-year growth between 188% and 219%. On the adjusted earnings per share front, the company’s guidance spans from $5.20 to $6.01. To provide context, in fiscal 2023’s third quarter, Supermicro reported adjusted earnings per share of $1.63. Achieving the midpoint of its guidance range would signify a remarkable 244% year-over-year growth in earnings per share.

Considering the recent indicators of strong demand, there is a reasonable expectation that the company’s fiscal Q3 sales and earnings might surpass the higher ends of these guidance ranges.

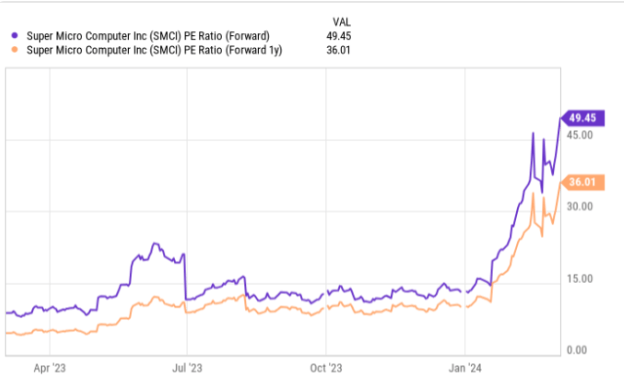

Trading at approximately 50 times this year’s anticipated earnings and 36 times next year’s projected earnings, Supermicro stands as a growth-dependent stock. However, considering the recent momentum in the business, its current valuation appears relatively inexpensive.

A notable metric is Supermicro’s forward price/earnings-to-growth (PEG) ratio, currently at around 0.55. With next year’s projected earnings growth rate, the one-year forward PEG ratio stands at approximately 0.68. Typically, a PEG ratio below 1 is interpreted as an indication that a stock may be undervalued, as the earnings growth supports a higher valuation multiple.

While uncertainties persist regarding the long-term demand trajectory for Supermicro’s offerings, it’s crucial for investors to recognize the elevated risk associated with its remarkable run-up. There is a possibility that the company’s future performance might not meet the current elevated expectations.

Nevertheless, the conditions appear favorable for Supermicro. Although some cyclical moderation in demand for its server technologies may occur, market dynamics suggest the company is well-positioned for years of robust sales and earnings growth.

The broader artificial intelligence server market is expected to sustain rapid growth, and Supermicro seems poised to continue gaining market share. While the stock may experience some volatility, it presents itself as a potential addition to the portfolios of AI-focused investors with an above-average risk tolerance.