Chipotle Mexican Grill (NYSE: CMG) has once again showcased its operational excellence with an impressive earnings report. In the first quarter, the company saw a remarkable 14.1% surge in revenue, reaching $2.7 billion, while comparable-restaurant sales climbed by 7%. Notably, its restaurant-level operating margins hit 27.5%, marking a 190 basis points increase from the previous year, demonstrating enhanced profitability despite inflationary challenges.

The driving forces behind Chipotle’s ongoing success are its menu innovation, strategic marketing, and technological advancements.

On the menu front, Chipotle excels in streamlining ingredients, enabling quicker food preparation and service, ultimately driving higher sales. Moreover, this ingredient efficiency also aids in maintaining stringent control over the supply chain, mitigating food costs.

Chipotle’s limited-time offerings (LTOs), like the reintroduction of the popular Chicken al Pastor dish, significantly contribute to foot traffic and transaction volumes, sometimes accounting for up to 20% of quarterly transactions. Coupled with robust marketing campaigns, such as the successful rebranding of its barbacoa menu item to “braised beef barbacoa,” the company consistently attracts and retains customers, fostering incremental transactions and spending.

By leveraging technology, Chipotle enhances customer engagement through its rewards program, currently boasting approximately 40 million members. Technological innovations like the Autocado and digital makelines further optimize operations, speeding up service and bolstering sales. Additionally, advanced tools for forecasting, labor deployment, and recruitment drive cost savings, ultimately enhancing profitability.

Chipotle’s relentless focus on menu innovation, strategic marketing, and technological integration underscores its continued growth trajectory and resilience in the market.

One potential risk

A potential risk that could potentially disrupt Chipotle’s trajectory in the short term is the significant increase in minimum wage for restaurant workers in California, which took effect in April. Quick-service restaurant workers in California now earn $20 per hour, representing a considerable hike. Notably, California stands as Chipotle’s largest state, housing approximately 14% of its U.S. locations.

In response to this wage hike, Chipotle implemented a menu price increase of 6% to 7% in California. The company clarified that California locations already exhibit lower cash flows compared to the system average, and the price adjustments are aimed at maintaining these cash flows. However, Chipotle acknowledged that this move would marginally impact its overall restaurant-level margins, reducing them by approximately 20 basis points.

The primary concern for Chipotle lies in potential customer resistance to the price hikes in California. With inflation already driving up prices across various sectors, there’s a risk that consumers may push back against further increases. Nevertheless, Chipotle has demonstrated resilience in the face of price adjustments in recent years, managing to sustain or even increase traffic despite inflationary pressures, even among lower-income demographics.

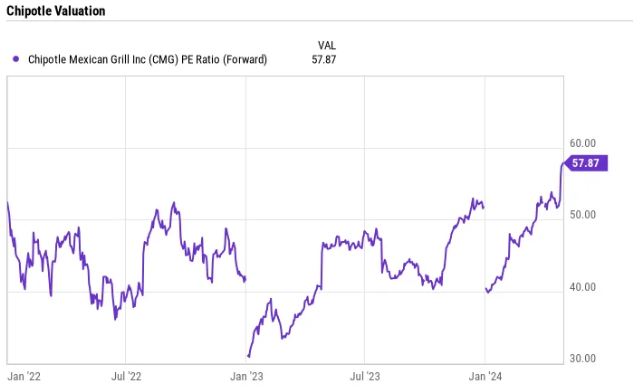

Should Chipotle succeed in maintaining or bolstering its customer traffic, the price hikes could prove beneficial, driving up same-store sales and ultimately bolstering profits. However, if these price adjustments lead to a slowdown in traffic, particularly in California, it could dampen investor sentiment. Trading at a forward price-to-earnings ratio of nearly 58x, Chipotle’s stock valuation is already lofty, making it susceptible to any disruptions that might cause investors to reevaluate its premium pricing.

Despite the short-term concerns posed by the California restaurant worker minimum wage hike, I remain optimistic about Chipotle’s long-term outlook. Any potential price dip resulting from this development could present a buying opportunity for investors. Chipotle remains well-positioned for continued growth, with ample opportunities for expanding its store base. Moreover, the company’s adeptness at driving traffic and boosting sales reaffirms its strength in the market. All things considered, Chipotle stands as a reliable restaurant stock for long-term ownership.