Amidst the ongoing market surge fueled by the artificial intelligence (AI) frenzy, one stock has been catching my attention amidst the record-breaking performances of the S&P 500 and Nasdaq Composite. Surprisingly, it’s not among the usual “Magnificent Seven.”

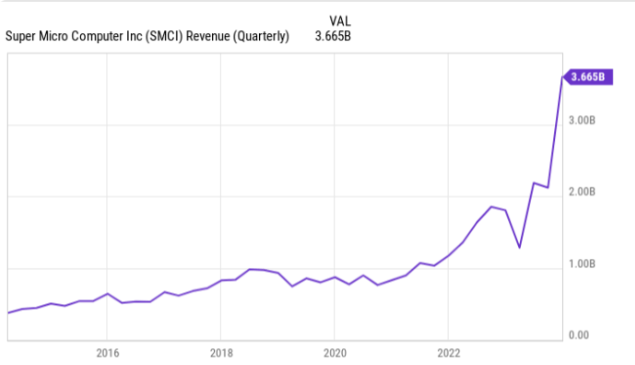

Super Micro Computing (NASDAQ: SMCI) has witnessed an astonishing 5,830% surge over the past five years, with its shares skyrocketing by over 300% since the beginning of 2024, as of market close on March 8. Much of this momentum stems from the company’s recent milestone: inclusion in the prestigious S&P 500 index.

At the heart of Super Micro’s remarkable ascent lies its pivotal role in the AI domain. Let’s delve into the intricacies of Super Micro’s business to grasp why its stock is experiencing such an exponential surge.

A superb run to the top, but…

Super Micro occupies a pivotal position at the crossroads of semiconductor technology and artificial intelligence (AI). Specializing in the design of integrated systems for IT architecture, its offerings encompass a range of solutions such as storage clusters and server racks.

Amidst the growing demand for graphics processing units (GPUs) from industry giants like Nvidia and Advanced Micro Devices (AMD) over the past year, Super Micro’s services have experienced heightened demand, operating discreetly in the background.

With revenue experiencing annual growth rates exceeding 100%, coupled with the favorable tailwinds of AI, Supermicro presents a promising long-term outlook. It’s not surprising that a Wall Street analyst has likened Supermicro to a “stealth Nvidia.”

However, beyond the impressive sales acceleration, it’s essential to delve deeper into other factors that contribute to the full investment thesis of Supermicro.

…there are some lingering concerns

Investors should recognize that Supermicro primarily operates in the hardware space, and its margin profile may not be as robust as initially perceived.

In the quarter ending on Dec. 31, the company reported a gross margin of 15.4%, marking a decline compared to both the previous quarter and the corresponding period of the previous year. Management attributed this margin deterioration to aggressive investments in new designs and efforts to expand market share, as discussed during the earnings call.

While investing in growth is a compelling argument, it has its limitations. In the long term, Supermicro will need to demonstrate its ability to achieve margin expansion and sustain consistent cash flow.

Valuation is becoming disconnected from fundamentals

While stocks like Nvidia and AMD are gaining attention due to their significant roles in the AI revolution, Supermicro’s close ties with these chipmakers have also sparked interest. However, it’s crucial to recognize that Supermicro and Nvidia operate in distinct realms, with only tangential connections at best. Comparisons with companies like Hewlett Packard Enterprise, Lenovo, Dell, and IBM are more appropriate, given Supermicro’s specialized nature.

Currently trading at a price-to-sales (P/S) ratio of 7, which is more than double that of IBM, Supermicro stands out as the most expensive stock within this group. However, its business is comparatively less diverse and relies heavily on specialized operations.

While Supermicro plays a significant role in the AI landscape, its low margins and expanding valuation suggest that the stock’s premium may be increasingly detached from its fundamentals. Despite its recent inclusion in the S&P 500, chasing the stock solely based on this milestone may not be prudent, particularly considering the potential near-term volatility as ETFs and passive funds rebalance their portfolios.

At present, it might be wise to adopt a wait-and-see approach and monitor the company’s performance. If Supermicro continues to be a key player in the AI narrative over the long term, there will likely be opportunities to invest at more suitable valuations.