Investing in high-yield dividend stocks often carries higher risks compared to their lower-yielding counterparts. These companies tend to have elevated dividend payout ratios, leaving limited margin for error. Any unforeseen challenges could potentially force them to reduce their dividend payments.

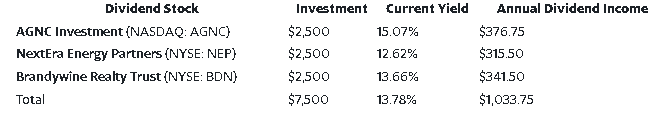

However, successful investments in high-yield stocks can be highly lucrative, offering investors substantial income. For instance, allocating a $7,500 investment across three high-yield dividend stocks has the potential to generate an annual passive income exceeding $1,000.

Here’s a closer look at what’s driving those big-time dividends and the factors to watch that could put them at risk of a reduction.

Earning enough to maintain the dividend (for now)

AGNC Investment operates as a real estate investment trust (REIT) specializing in mortgage-backed securities (MBS) backed by government agencies such as Fannie Mae, ensuring protection against credit losses. Although agency-backed MBS are considered low-risk fixed-income investments, their returns are relatively modest.

To enhance returns, residential mortgage REITs like AGNC employ leverage. However, leveraging also introduces higher risks, especially during periods of rising interest rates, leading to increased borrowing costs and potentially impacting profit margins.

AGNC has a history of adjusting its monthly dividend due to various risks, including those associated with leverage and market conditions. The company emphasizes the importance of earning a sufficiently high return on equity to cover expenses and dividends. Currently, the dividend aligns with its returns, but any deterioration in market conditions or other factors could necessitate further adjustments to its payout.

This reset plan could give it the power to continue increasing the payout

NextEra Energy Partners possesses a expanding portfolio of clean-energy infrastructure, encompassing wind farms, solar projects, and natural gas pipelines. The stable income generated from these assets is predominantly distributed to investors through dividends.

The company relies on a combination of debt and convertible equity portfolio financing (CEPF) to fund its operations. The challenge arises from the impact of rising interest rates, making it difficult to refinance maturing debt and fulfill the necessary repurchases of CEPF as they come due. To address these challenges, NextEra Energy has made strategic adjustments, including the sale of gas pipeline assets to repay maturing CEPF and a moderation in its dividend growth projections.

The revised outlook anticipates an annual dividend increase of 5% to 8% through 2026, targeting a 6% growth rate (down from the initial 12% to 15%). This growth is planned through strategic investments in high-return projects, specifically the repowering of existing wind farms.

However, the proposed plan would result in a payout ratio in the mid-90s, indicating a relatively high level. If the company encounters difficulties in executing its strategy, there may be a need to temporarily halt dividend growth or consider a payout reduction.

A towering yield

Brandywine Realty Trust holds a portfolio of office and mixed-use properties concentrated in Philadelphia and Austin, Texas. The REIT derives its revenue primarily from stable rental income, with a significant portion allocated towards dividend payments.

Similar to other office-focused REITs, Brandywine has encountered challenges stemming from reduced demand due to the prevalence of remote and hybrid work models. This has impacted occupancy rates, rental rates, and overall income, leading to a dividend reduction in the recent past.

Even after the dividend adjustment, Brandywine maintains a relatively high dividend payout ratio, ranging from 90% to 95% of its cash available for dividends in 2024. This tight ratio leaves limited room for financial flexibility and error.

Despite this, the company boasts ample liquidity and faces only one bond maturity through 2027. Additionally, Brandywine is actively divesting noncore assets, generating cash to fortify its balance sheet and support ongoing development initiatives.

Assuming successful execution of its strategic plans and stable market conditions, Brandywine could sustain its dividends at the adjusted level.

High-risk, high-reward dividend stocks

AGNC Investments, NextEra Energy Partners, and Brandywine Realty Trust presently yield dividends in the double digits, potentially transforming a $7,500 investment into an annual income exceeding $1,000. However, the assurance of sustaining these payouts comes with elevated risks of potential dividend cuts. While the companies express an intention to maintain dividends, investors considering these high-yield stocks should possess a high-risk tolerance due to the inherent uncertainties.