Discover the perfect online broker tailored to your personal needs and goals. Enjoy a customized trading experience, exceptional conditions & fees, and access our team of experts for any questions you may have!

Register for Account

Simply sign up online for a Korata account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using Ava trade's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

AvaTrade offers a good number of account types:

- AvaTrade Demo account.

- AvaTrade Standard account.

- AvaTrade Spread Betting account.

- AvaTrade Islamic account.

- AvaTrade Professional account.

Our Take on AvaTrade

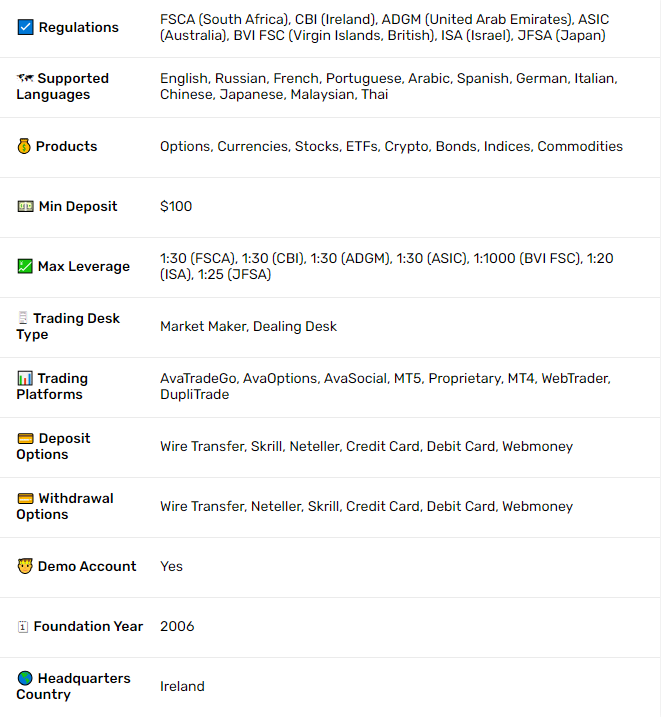

Established in 2006 and based in Ireland, AvaTrade emerges as a multi-licensed forex and CFD broker providing access to over 840 CFDs and vanilla options.

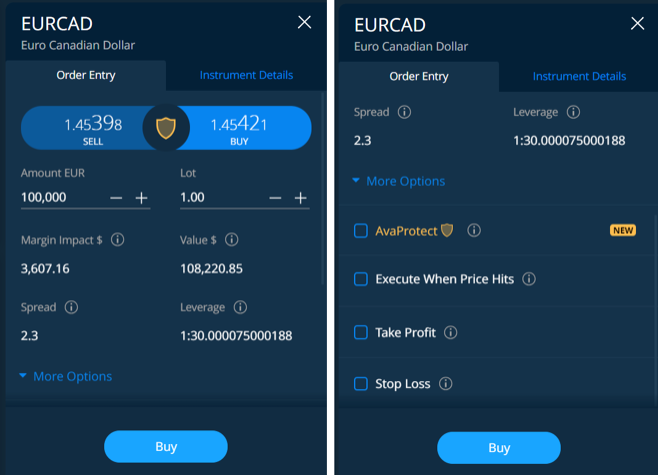

Setting itself apart with a diverse range of platforms, competitive trading fees, a plethora of trading tools, and an extensive educational repository, AvaTrade also boasts a distinctive risk management tool called AvaProtect.

AvaTrade is particularly well-suited for longer-term day and position traders due to its low swaps and advanced risk management features. Moreover, it caters to novice traders seeking to grasp technical analysis intricacies or participate in copy trading.

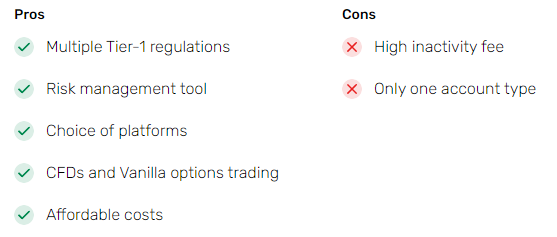

AvaTrade Pros and Cons

AvaTrade Highlights for 2024

Strong Fund Security: AvaTrade maintains regulation across multiple jurisdictions, including by reputable entities like the CBI, ASIC, and JFSA.

Innovative Risk Management Tool: AvaTrade introduces AvaProtect, a distinctive tool enabling full hedging of individual positions.

Competitive Fee Structure: AvaTrade’s trading and non-trading fees consistently undercut industry averages.

Wide Range of Trading Platforms: AvaTrade offers three proprietary trading platforms alongside a mobile app. It also integrates MetaTrader 4 & 5 and DupliTrade for enhanced versatility.

Comprehensive CFDs and Options Selection: With over 840 CFDs and options available, traders can effectively speculate and hedge against price fluctuations.

Ideal for Day and Position Traders: AvaTrade is particularly suited for longer-term trading strategies, thanks to its below-average swap fees.

What Sets AvaTrade Apart?

AvaTrade amalgamates comprehensive security measures, competitive pricing, and an extensive array of trading platforms and tools.

Moreover, it introduces the groundbreaking AvaProtect insurance and risk mitigation tool. This innovation allows traders to insure a designated trade for up to $1 million, with hedging costs factored in at the point of purchase.

Who is AvaTrade For?

I’ve determined that AvaTrade is an excellent fit for both day and position traders due to its advantageous swap fees and diverse range of instruments, which adeptly address the risks associated with long-term trading strategies.

Novice technical traders will appreciate the wealth of educational materials provided by AvaTrade, especially its extensive resources on technical analysis, alongside its sophisticated copy trading functionalities.

AvaTrade Main Features

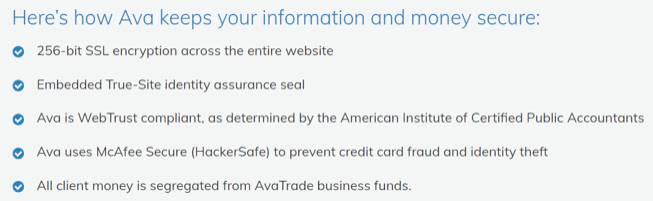

Is AvaTrade Safe to Trade With?

AvaTrade prioritizes crucial safety measures, including segregated funds and negative balance protection. It has further introduced innovative tools like AvaProtect and a robust client categorization system, enabling inexperienced traders to steer clear of unnecessary trading risks.

Additionally, the broker adheres to a ‘best execution policy,’ guaranteeing clients consistently receive optimal price quotes. Considering these factors, I confidently conclude that AvaTrade is a secure choice for trading.

Stability and Transparency

In our Trust category assessments, we thoroughly examine factors concerning stability and transparency, concentrating on the broker’s longevity, company size, and the accessibility of transparent information.

My examination of AvaTrade’s transparency involved reviewing its legal documentation. I found that the broker offers extensive information regarding its range of services, without employing any misleading language or encountering significant discrepancies.

I also evaluated AvaTrade’s fee transparency by making sure that the spread rates listed on the website matched the live quotes on the platform. I did not see any discrepancies, and everything seemed in order.

In summary, my research indicates that AvaTrade can be regarded as having a very high level of trust and stability due to the following factors:

- Tightly regulated globally

- Developed an innovative risk-management tool

- Transparent legal docs

- Best execution policy

- Client categorization policy

AvaTrade Trading Fees

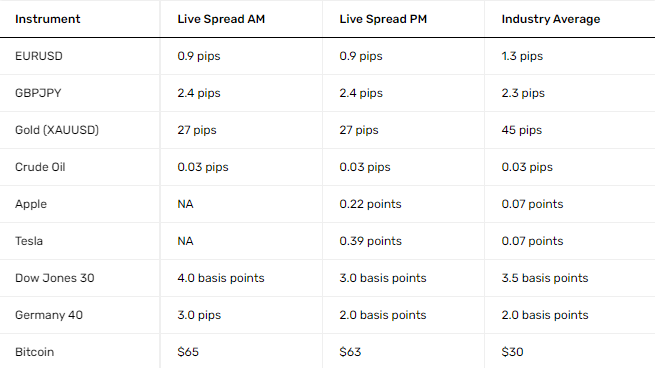

AvaTrade Spreads

I conducted a thorough assessment of AvaTrade’s spreads during peak trading periods, specifically during the London open at 8:00 a.m. GMT and shortly after the U.S. open at 2:45 p.m. GMT, on the 30th of January 2024. The findings of this examination are detailed in the following table:

Categorized by asset class and benchmarked against industry standards, AvaTrade presents competitive spreads across various financial instruments. Specifically, the platform offers tight spreads on share CFDs, while displaying spreads ranging from low to average for currency pairs and commodities. Indices exhibit average spreads, whereas cryptocurrencies feature comparatively wider spreads.

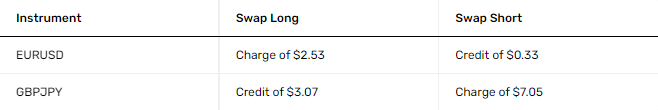

AvaTrade Swaps

A swap fee represents the expense incurred by traders for maintaining an open position overnight, typically due to fluctuating interest rates. Swap long denotes the fee deducted or credit received for holding a long (buy) position overnight, while swap short pertains to the charges or credits incurred for holding a short (sell) position overnight.

Below are the values listed for one full contract, equivalent to 100,000 units, of the base currency.

My findings indicate that AvaTrade’s low swaps accommodate the execution of day trading and position trading strategies, which require multiple days to complete.

Swap-free trading is also possible via AvaTrade’s Islamic accounts.

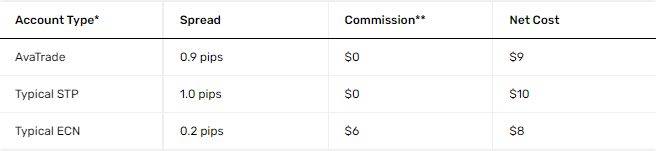

Accounts Comparison

I’ve constructed the table below to facilitate a comparative analysis of trading fees between AvaTrade’s retail account type and the industry average. It presents the spreads and commissions recorded for the EUR/USD pair and contrasts them with the typical costs associated with ECN and STP accounts in the broader industry.

This table illustrates the total expenses incurred to execute a trade for 1 full lot (100,000 units) on the EUR/USD, with each pip valued at $10, across different account types.

To compute the total cost of such a full-sized trade, I employed the following formula: Spread × pip value + commission.

Based on my assessments, AvaTrade’s standard account type generally presents more favorable conditions than the average STP account, yet slightly less advantageous conditions in comparison to the typical ECN account. However, it’s worth noting that this discrepancy may vary depending on the specific instrument being traded.

AvaTrade’s Web Trader Platform

General Ease of Use

I found the exploration of AvaTrade’s Web Trader platform quite enjoyable. The platform offers a sophisticated instrument search bar, allowing for quick and effortless navigation. Additionally, its charts are visually appealing, providing traders with detailed insights into price action behavior, thus enhancing their trading experience.

Charts

In my opinion, the chart screen stands out as the most crucial feature of any trading platform. It serves as the cornerstone for technical analysis by offering a comprehensive view of price action behavior. Chart enthusiasts leverage a myriad of analytical tools and configuration options to scrutinize it from various perspectives. From my experience, the paramount aspect of a chart lies in its ease of use when scaling price action up or down, allowing for seamless analysis at different levels of granularity.

Below is a breakdown of the available analytical tools and chart configurations:

80 Technical Indicators: AvaTrade’s platform boasts a wide array of 80 technical indicators, encompassing trend-based, volume-based indicators, oscillators, and more. These tools serve to analyze price action behavior and discern underlying market sentiment. They are instrumental in predicting potential market movements. Notably, the platform surpasses the industry average in terms of the number of technical indicators offered.

13 Drawing Tools: The platform provides 13 drawing tools, including Fibonacci retracement levels, which are essential for studying repeatable price patterns and identifying key support and resistance levels, as well as potential breakout or breakdown levels. However, it’s worth noting the absence of the Elliott Waves tool, which was surprising given the otherwise comprehensive charting capabilities.

9 Timeframes: AvaTrade’s Web Trader allows for multi-timeframe analysis of price action behavior across nine different timeframes. The inclusion of multiple timeframes enables traders to conduct intricate examinations spanning short-term and long-term perspectives. However, the platform’s lowest timeframe of 1 minute may be deemed insufficient for successful high-frequency trading strategies such as scalping.

3 Chart Types: Price action can be visualized in three different chart types: line, bars, or candlesticks. This variety enables traders to examine potential trading opportunities from various perspectives, catering to different trading styles and preferences.

Orders

Market Orders: Market orders are utilized for immediate entry into a trade at the prevailing market price. Upon execution, they ensure volume filling, although there may be a variance between the requested price and the actual execution price.

Limit Orders: Unlike market orders, limit orders guarantee execution at a specific price level. However, a limit order will only be filled if the market price reaches the predetermined execution price.

Stop Orders: These orders are employed to manage open positions by limiting potential losses if the market moves against the trader’s position. A stop-loss order is set at a designated price level below (for long positions) or above (for short positions) the current market price. If the market price reaches the stop-loss level, the order is triggered and converts into a market order, filling at the best available price.

My Key Takeaways After Testing the Web Trader Platform

In my assessment, AvaTrade’s Web Trader platform emerges as a prime selection for chart enthusiasts keen on meticulously analyzing price action behavior. Boasting a user-friendly interface and a plethora of technical indicators, it facilitates seamless navigation and in-depth market scrutiny.

Furthermore, the platform integrates trading insights directly from TradingCentral, streamlining the decision-making process for traders and saving valuable time and effort. Additionally, the innovative AvaProtect tool enhances the platform’s appeal by offering traders the capability to hedge their positions effectively, thereby managing risk with greater precision.

AvaTrade’s AvaTradeGO Mobile App

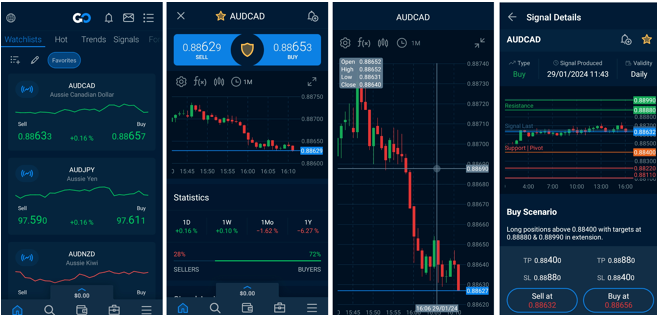

The AvaTradeGO mobile app offers traders convenient access to the market while on the move, facilitating swift monitoring and adjustment of open trades. Given the volatile and dynamic nature of the market, staying abreast of developments is paramount.

With the app, users can effortlessly place market, limit, and stop orders, as well as fine-tune the exposure of their existing trades. Moreover, the app proves highly convenient for evaluating trading signals provided by TradingCentral, empowering traders with valuable insights to inform their decision-making process.

The Bottom Line

AvaTrade emerges as a well-rounded brokerage, adept at meeting the requirements of both novice traders and seasoned professionals. Established in 2006 and headquartered in Ireland, AvaTrade operates under licenses from multiple jurisdictions, ensuring compliance with stringent safety regulations.

The brokerage offers a range of highly functional platforms and mobile apps tailored to diverse trading styles. Noteworthy features include DupliTrade for social trading and the Guardian Angel Suite for advanced risk management on both MT4 and MT5 platforms.

AvaTrade distinguishes itself with innovative offerings such as AvaProtect, a unique risk management service, along with a wide selection of platforms, competitive costs, and a diverse array of trading instruments. Traders can access hundreds of CFDs and vanilla options across various asset classes.

In summary, my evaluation suggests that AvaTrade is an ideal choice for technical traders at any skill level. While accommodating high-frequency trading as a market maker, its favorable swap rates make it particularly suitable for day trading and position trading strategies.