Eightcap is regarded as trustworthy, boasting an impressive overall Trust Score of 85 out of 99. While it is not publicly traded and doesn’t function as a bank, Eightcap is authorized by three Tier-1 regulators, indicating a high level of trustworthiness. Additionally, it is not regulated by any Tier-2 or Tier-3 regulators, signifying relatively lower risk. However, it is regulated by one Tier-4 regulator, suggesting a higher level of risk in that jurisdiction.

Eightcap Account Types

The platform boasts two types of accounts, catering to traders with different experience levels. Whether you are a beginner or an experienced trader, you can find the account type that suits your needs. Let’s take a look at them:

Register for Account

Simply sign up online for a Eightcap account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using Eight cap's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

Eightcap pros & cons

Pros:

- Founded in 2009, Eightcap is regulated in three Tier-1 jurisdictions and two Tier-4 jurisdictions, ensuring a high level of oversight.

- Eightcap provides a diverse range of written research articles and third-party content, including insights from BK Crypto Crusher.

- With over 200 cryptocurrency CFDs available, Eightcap was honored with the 2024 Annual Award for #1 Most Cryptos.

- The platform offers the award-winning TradingView platform, particularly favored by its U.K.-based clients.

Cons:

- Eightcap offers a narrow range of just over 900 CFD symbols and only 56 forex pairs, limiting market options.

- Research content provided by Eightcap lacks depth, variety, and consistency.

- The MetaTrader suite is not available to investors in the U.K. through Eightcap.

- Educational resources at Eightcap lack filtering options by experience level and do not include progress-tracking features.

- Compared to leading forex brokers for beginners, Eightcap’s educational video offerings are limited. Additionally, the range of markets, accounts, and execution methods available may not match those of the top MetaTrader brokers.

Offering of investments

Eightcap offers a selection of 56 forex pairs and approximately 900 CFDs, aligning with the industry standard for investment offerings. Investors can access various asset classes, including shares, indices, commodities, and cryptocurrencies. The availability of markets at Eightcap depends on factors such as the trading platform used, the client’s country of residence, and the specific Eightcap entity managing the account. Cryptocurrency trading is facilitated through CFDs rather than direct purchase of the underlying asset (e.g., buying Bitcoin). It’s important to note that Crypto CFDs are not accessible to retail traders through any broker’s U.K. entity, nor to U.K. residents.

Commissions and fees

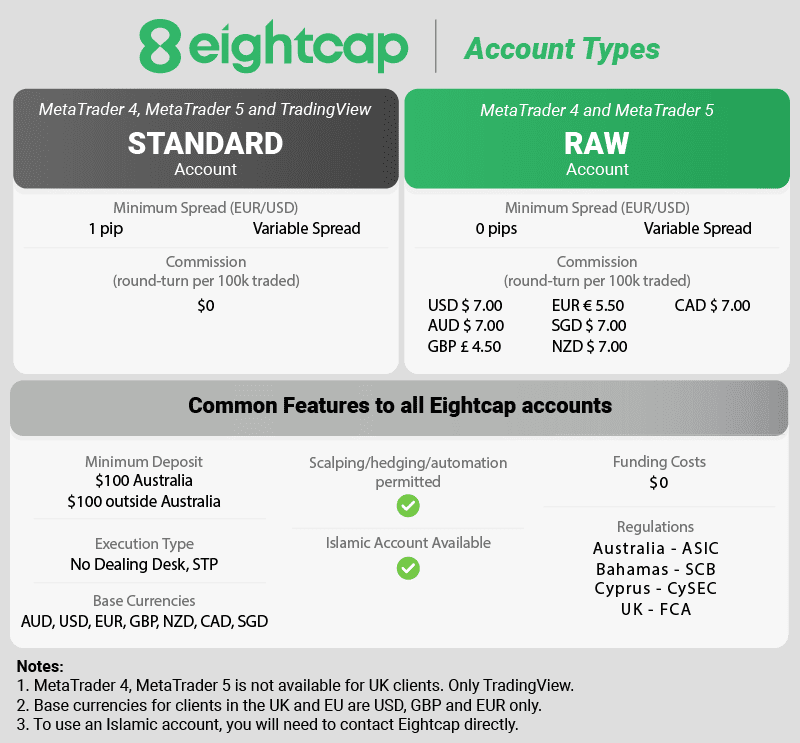

Eightcap provides two account types across its global entities, including those in Australia and the Bahamas. The fees and commissions you incur will depend on whether you opt for the commission-based Raw account or the spread-only Standard account.

For its commission-based Raw account, Eightcap advertises an average spread of 0.06 pips. However, when considering the per-side commission of $3.50 per trade, the total cost amounts to approximately 0.76 pips. This places Eightcap just below the industry average of 0.8 pips.

In summary, while Eightcap is slightly more expensive than the most budget-friendly forex brokers, its costs remain competitive within the industry.

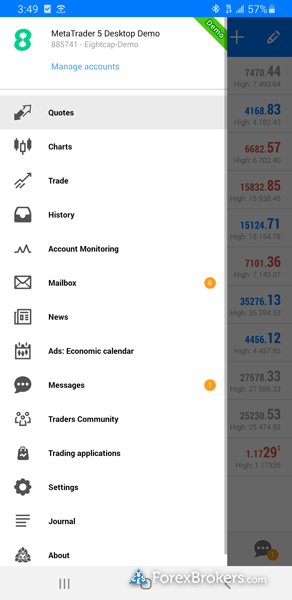

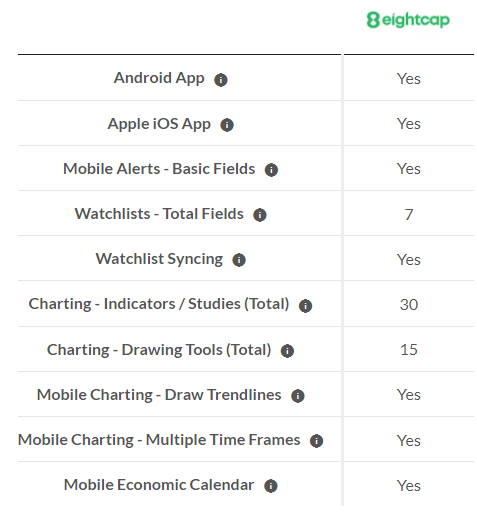

Mobile trading apps

Without a proprietary mobile app, Eightcap faces challenges competing with industry leaders such as IG and Saxo. For recommendations on top trading apps, refer to our guide on the best forex trading apps.

Regarding apps, Eightcap provides access to the MetaTrader platform suite. Both iOS and Android versions of the MT4 and MT5 apps are downloadable from the Apple App Store and Google Play store, respectively. Additionally, Eightcap offers the TradingView mobile app, renowned for its robust charting features. For further details, explore our guide on TradingView.

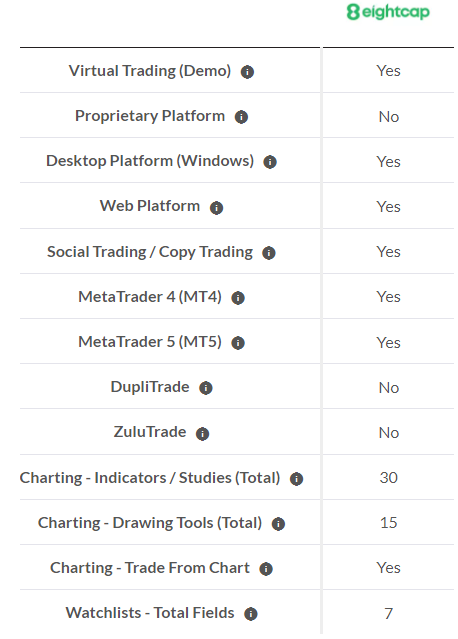

Other trading platforms

Eightcap provides access to the complete MetaTrader platform suite, including both MetaTrader 4 and the newer MetaTrader 5. Additionally, clients who deposit a minimum of $500 can access popular tools from third-party providers like TradingView and BK Crypto Crusher. Furthermore, Eightcap supports Capitalise.ai, enabling integration of algorithmic trading software within your MetaTrader 4 (MT4) account.

With these additional features, Eightcap has made significant strides towards offering a comprehensive suite comparable to the offerings of top MetaTrader brokers.

Trading tools: Alongside resources from BK Crypto Crusher and its in-house Eightcap Labs initiatives, Eightcap offers access to Capitalise.ai. This third-party platform allows users to develop automated trading strategies in plain English, eliminating the need for coding skills.

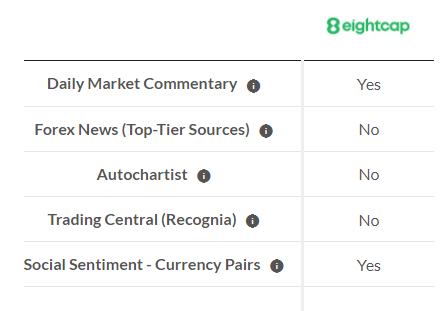

Market research

Eightcap provides a modest variety of research content, featuring daily updates in both written and video formats. However, its research offerings do not match the comprehensive offerings of top brokers.

Research overview: Eightcap’s research mainly consists of daily written updates, including its Trading Week Ahead series, supplemented by occasional videos on its YouTube channel. These videos include the Market Update and Trade Zone series, along with content from Eightcap Labs.

Market news and analysis: Integrating third-party research tools and content, such as Autochartist and Trading Central, could enhance Eightcap’s research offerings and elevate its standing in this category.

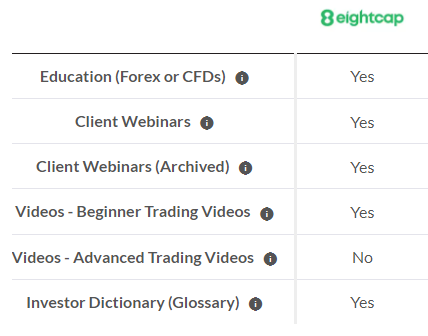

Education

Eightcap’s educational resources provide a diverse range of written articles but offer a limited selection of videos. Unlike some of the leading brokers in this category, Eightcap lacks structured lesson programs with quizzes and progress tracking features.

Learning center: Eightcap’s educational videos include just a dozen offerings, alongside a few archived webinars like the TraderFest series covering CFDs and forex. These resources are available on the firm’s YouTube channel, organized by playlist. While the selection of written educational content has expanded, with approximately 74 articles covering fundamentals and trading strategies, following the launch of Eightcap Labs.

Room for improvement: Enhancing the variety of educational videos and categorizing articles based on experience levels would contribute to a more balanced educational offering from Eightcap.

Final thoughts

Eightcap has made notable progress in enhancing the standard MetaTrader platform suite by providing various platform plug-ins and granting access to third-party tools like Capitalise.ai. Additionally, its extensive offering of cryptocurrency pairs surpasses that of nearly every other broker reviewed, earning it the 2024 Annual Award for #1 Most Cryptos.

However, despite these advancements, significant challenges persist for Eightcap to establish itself as a leading MetaTrader broker. These hurdles include a limited range of available markets and the absence of a proprietary mobile app.