The BDSwiss brand serves a large community of over 1.6 million registered forex and CFD traders, providing access to the complete MetaTrader platform suite in addition to its proprietary BDSwiss Mobile and WebTrader apps. BDSwiss boasts favorable order execution statistics, which are regularly published by the broker. The platform also offers quality research resources and a wide selection of over 1,000 tradable symbols. However, it’s worth noting that BDSwiss’s spreads are slightly higher compared to industry leaders.

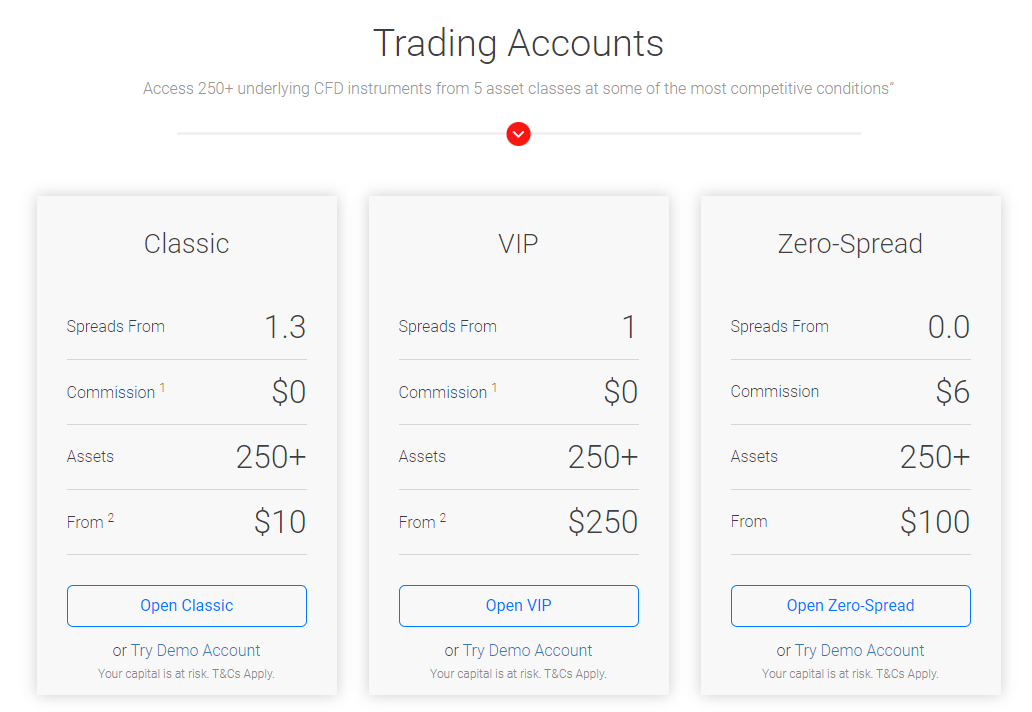

BDSwiss Account Types

The platform boasts three types of accounts, catering to traders with different experience levels. Whether you are a beginner or an experienced trader, you can find the account type that suits your needs. Let’s take a look at them:

Register for Account

Simply sign up online for a BDSwiss account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using BDSwiss's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

BDSwiss Pros & Cons

Pros:

- BDSwiss offers multiple platforms, including its BDSwiss Mobile and WebTrader apps, as well as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- The Triple Zero account, introduced in February 2022 and available to new clients outside the EU, features all-in pricing close to zero pips for a 12-month promotional period.

- Daily Videos market coverage series is produced by in-house staff.

- As an agency broker, BDSwiss demonstrates balanced slippage with no requotes or order rejections, with execution statistics published monthly.

- BDSwiss provides access to Autochartist and its proprietary Trends Analysis tool.

- Trading signals and real-time alerts are accessible via the BDSwiss Telegram channel.

- The RAW account offers lower spreads and commissions (requires a $5,000 deposit).

- VIP clients gain access to the Premium version of Trend Analysis, featuring 500 trend patterns.

- BDSwiss launched Trade Companion as a trade analytics tool, available with a deposit of at least $500.

- AI-powered Trends Analysis tool launched in WebTrader.

Cons:

- The proprietary mobile app offered by BDSwiss is fairly basic compared to other platforms.

- Beginner’s educational content lacks a progress-tracking feature.

- The spread of 1.6 pips on the EUR/USD for its Classic account is considered expensive, despite favorable execution statistics.

- BDSwiss does not permit scalping.

- The FCA has directed BDSwiss to cease offering CFDs to U.K. clients due to regulatory concerns about its marketing practices.

- BDSwiss no longer accepts EU residents.

- BDSwiss imposes a steep $30 inactivity fee, charged after 90 days with no trading activity.

Is BDSwiss UK regulated?

BDSwiss is no longer regulated by the Financial Conduct Authority (FCA) in the United Kingdom (U.K.). However, it maintains multiple regulatory licenses across the European Union (EU), including authorization from the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. Despite this, BDSwiss no longer accepts residents from the EU. Additionally, it operates as a Tied Agent under its German entity and is passported across the EU and beyond, including Switzerland. It’s important to note that as of January 2024, BDSwiss is not accepting clients from the EU. The brand also holds an offshore regulatory license from the island nation of Mauritius.

What happened with BDSwiss in the UK?

In May 2021, the Financial Conduct Authority (FCA) took action against BDSwiss due to prohibited marketing practices by some of its affiliates and social media influencers. As a result, the FCA required BDSwiss to cease conducting business in the U.K. and refrain from marketing to U.K. residents until certain issues were addressed by the broker, as outlined in the FCA’s announcement.

In essence, the FCA introduced regulations that restrict the marketing and sale of Contracts for Difference (CFDs) to retail consumers, and BDSwiss, through its affiliates, was found to have violated these rules.

BDSwiss collaborated with affiliates who directed referrals to retail traders, predominantly to BDSwiss’ overseas entities that do not offer FCA protections. This meant that U.K. consumers were encouraged to open accounts with a broker associated with the FCA but did not receive the protections expected from an FCA-regulated broker.

According to the FCA, “almost 99% of them were referred to the Overseas Firms, meaning the clients did not benefit from the protections afforded to consumers dealing with an authorized firm.” Additionally, BDSwiss’ affiliates promoted trading signal providers without adequately disclosing that the recommended financial instruments were CFDs.

Post-Brexit note: Before Brexit, many EU brokers, previously passported under MiFiD in countries like the U.K., had to either obtain full registration with the U.K. post-Brexit or operate under a Temporary Permission Regime (TPR) while seeking regulation or exiting the U.K. BDSwiss is no longer operating under the TPR in the U.K. and is not authorized by the FCA.

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their offerings are the result of meticulous data collection, expert observations, and qualified opinions from our team of researchers. Annually, we produce extensive research, comprising tens of thousands of words, on the top forex brokers, while closely monitoring numerous international regulatory agencies. Our Trust Score calculation method is transparent and ensures an objective evaluation of each broker.

Our research team conducts comprehensive testing across a spectrum of features, products, services, and tools, validating thousands of data points in the process. We rigorously assess all available trading platforms, whether proprietary or third-party, based on a range of data-driven variables.

Additionally, we delve deep into each broker’s commissions and fees, including bid/ask spreads for popular forex currency pairs. We scrutinize other trading costs such as inactivity fees, minimum deposit requirements, VIP incentives, and various fee-related aspects.

Furthermore, our evaluation encompasses vital categories such as mobile trading accessibility and functionality, availability of market research and educational resources, and the overall Trust Score of each broker.

Forex Risk Disclaimer

Trading securities involves a significant level of risk. Margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies carry particularly high levels of risk due to factors such as leverage, creditworthiness, limited regulatory protections, and market volatility. These risks can substantially impact the price or liquidity of a currency or related instrument.

It is important to understand that the methods, techniques, or indicators presented in trading products may not always be profitable, and they may result in losses. Therefore, traders should exercise caution and thoroughly research and understand the risks involved before engaging in any trading activity.