FxPro stands out as a premier trading partner, offering distinct advantages in the bustling landscape of online trading. Its intuitive platform, coupled with competitive spreads and an extensive range of assets, ensures traders benefit from a comprehensive and adaptable trading journey.

FxPro Account Types

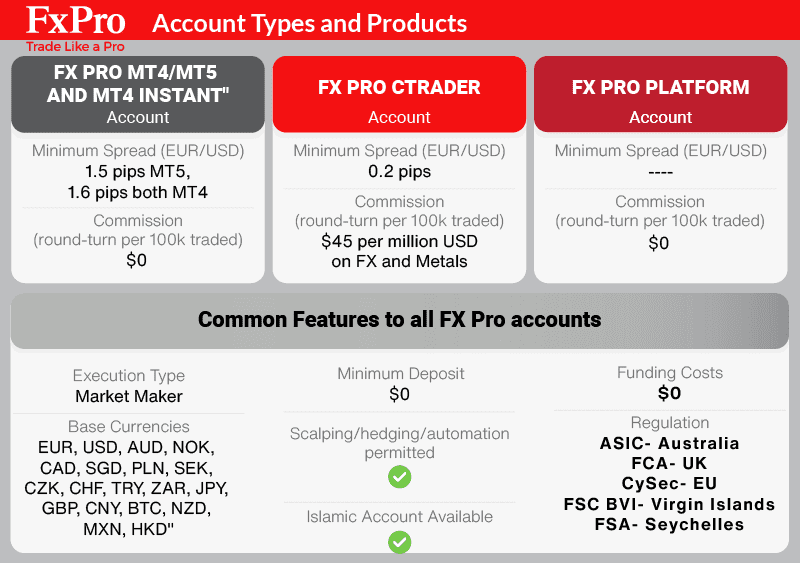

The platform boasts three types of accounts, catering to traders with different experience levels. Whether you are a beginner or an experienced trader, you can find the account type that suits your needs. Let’s take a look at them:

Register for Account

Simply sign up online for a FxPro account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using FxPro's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

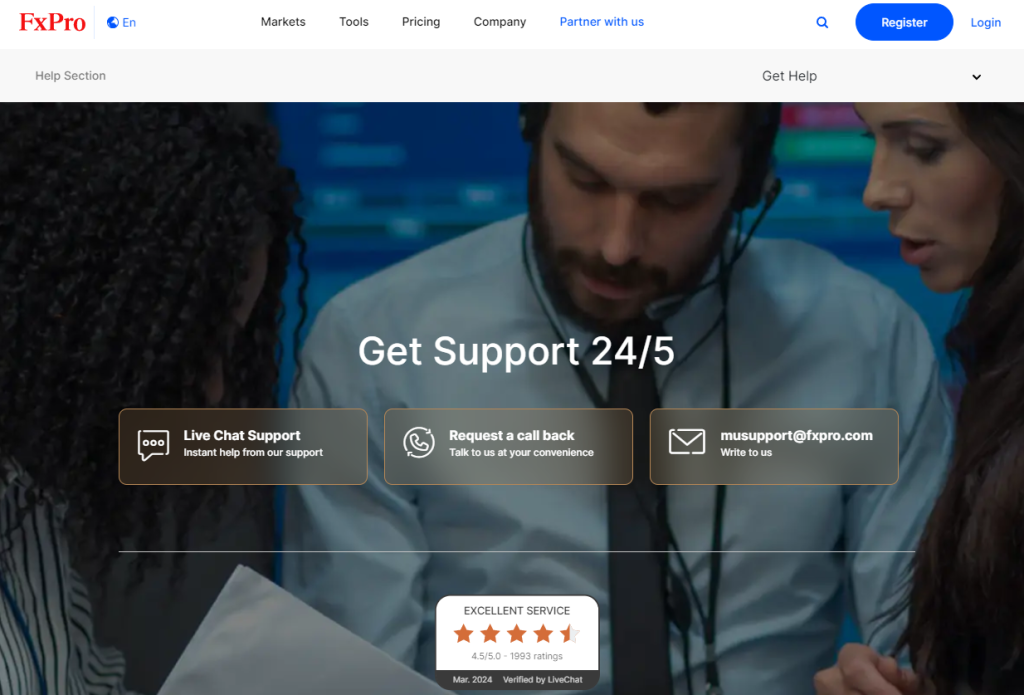

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

FxPro Pros & Cons

Pros:

- Regulation: FxPro boasts regulation in multiple tiers, enhancing trust and reliability for traders.

- Pricing Options: The flexibility in pricing options, including fixed and variable spreads, accommodates diverse trading strategies.

- Platform Variety: FxPro’s support for MetaTrader and cTrader platforms across various devices ensures accessibility and convenience for traders.

- Transparent Execution: With a low rate of order requotes, FxPro maintains transparency and reliability in executing client orders.

- Algo Trading: The cTrader account offering’s lower spreads contributed to FxPro being recognized for excellence in algo trading in 2024.

Cons:

- Competitive Pricing: FxPro’s pricing may not be as competitive as industry leaders like IG and CMC Markets, potentially impacting its appeal to cost-conscious traders.

- Proprietary Platform: While FxPro Edge shows promise as a web-based platform, it falls short of rivaling the best proprietary trading platforms.

- Limited Symbols: FxPro offers a narrower range of symbols compared to leading multi-asset brokers, potentially limiting trading opportunities for clients.

- Segmented Experience: The separation of the BnkPro app from the FxPro client experience under the BnkPro brand may lead to a fragmented user experience.

Commissions and fees

FxPro’s pricing tends to be above the industry average, placing it at a disadvantage when compared to competitors like Pepperstone or IC Markets, both of which offer the full MetaTrader and cTrader suites.

When it comes to execution methods, FxPro’s MT4 offering allows traders to opt for either variable or fixed spreads. Under variable-spread pricing, there are two execution types: instant and market. Instant execution may lead to requotes but avoids slippage, while market execution might involve slippage but does not entail requotes.

FxPro’s most competitive spreads are found on its cTrader platform, which adopts commission-based pricing. For instance, the effective spread for trading the EUR/USD pair on cTrader is approximately 1.27 pips. This calculation considers FxPro’s average spread (as of August 2020) of 0.37 pips, along with a commission-equivalent of 0.9 pips.

Regarding spreads, FxPro’s floating-rate model, available on MT4 and MT5, offers EUR/USD spreads of 1.58 for accounts using market execution (1.51 pips on MT5) and 1.71 for accounts with instant execution – based on FxPro’s data from August 2020.

However, on MT5, there is no fixed-spread offering, and only market execution is supported.

For active traders, FxPro provides an Active Trader program within its VIP account offering, offering discounts of up to 30%. While this benefit is generous, it still falls short compared to similar programs offered by leading competitors such as FOREX.com, IG, and Saxo.

FxPro’s standout feature lies in its capability to execute large orders without any minimum distance from the current market price.

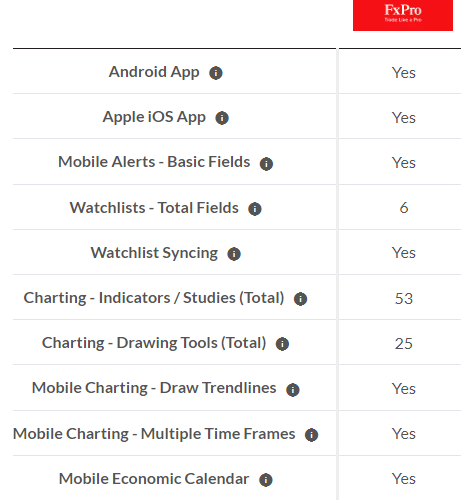

Mobile Trading Apps

FxPro offers a range of mobile apps tailored to different trading needs. Its proprietary FxPro Edge app serves as an all-in-one solution for trading, account management, and accessing basic market news. Additionally, clients can access third-party mobile apps powered by MetaQuotes and Spotware, the same providers behind FxPro’s desktop and web platforms: MetaTrader and cTrader, respectively. Moreover, FxPro extends its services to share trading through the BnkPro app, which is slated to incorporate a Mastercard debit card and banking service in the future.

In terms of ease of use, FxPro Direct, the proprietary mobile app, prioritizes account management while also supporting trading for CFD account holders. It offers basic charting functionality but lacks advanced drawing tools and indicators, except for volume data. FxPro Edge is also available for mobile, although accessibility may be limited due to country restrictions on app stores. Overall, FxPro presents a selection of four mobile apps, including MT4, MT5, cTrader, and its flagship FxPro Edge app, catering to diverse trading preferences and needs.

Market Research

FxPro ensures clients stay informed with daily market updates and analysis available on its blog, supplemented by content from third-party providers. While the in-house team produces high-quality articles, FxPro’s YouTube channel primarily focuses on webinars, platform tutorials, and promotional content, with the exception of its Russian channel which offers daily videos. In comparison, XM Group and Tickmill produce numerous research videos daily.

In terms of research, FxPro’s blog offers multiple daily articles, including Market Overview, Technical Analysis, and Crypto Review series, accessible within the FxPro Edge platform. Dow Jones International headlines stream in FxPro’s MetaTrader platform, while FxPro Edge integrates an economic calendar and news module with market analysis.

For market news and analysis, FxPro’s client portal offers sentiment data for various symbols and forex pairs, trading session times, and a summary of gainers and losers, alongside an integrated economic calendar. Centralizing these resources into one portal or merging them with the Edge platform could enhance FxPro’s platform usability by providing a seamless user experience.

Final thoughts

FxPro stands out as a well-capitalized and reputable broker, offering a diverse range of platform options and trade execution methods, along with the capability to efficiently handle large orders for professional traders.

However, FxPro’s pricing tends to be higher than the industry average, and its proprietary FxPro Edge app is currently limited and unavailable for mobile devices.

Despite these drawbacks, FxPro excels in providing various options for algorithmic trading, including platforms and execution methods, making it particularly appealing to active traders who utilize automated trading systems. This commitment to serving the needs of algorithmic traders led to FxPro being awarded Best in Class honors for Algo Trading and MetaTrader in our 2024 Annual Awards.