Libertex, under the regulation of the Cyprus Securities and Exchange Commission (CySEC), offers a safe haven for European investors. Its intuitive platforms, favorable terms, and cutting-edge functionalities such as copy trading cater to novices and seasoned traders alike, fostering a secure and accessible trading environment.

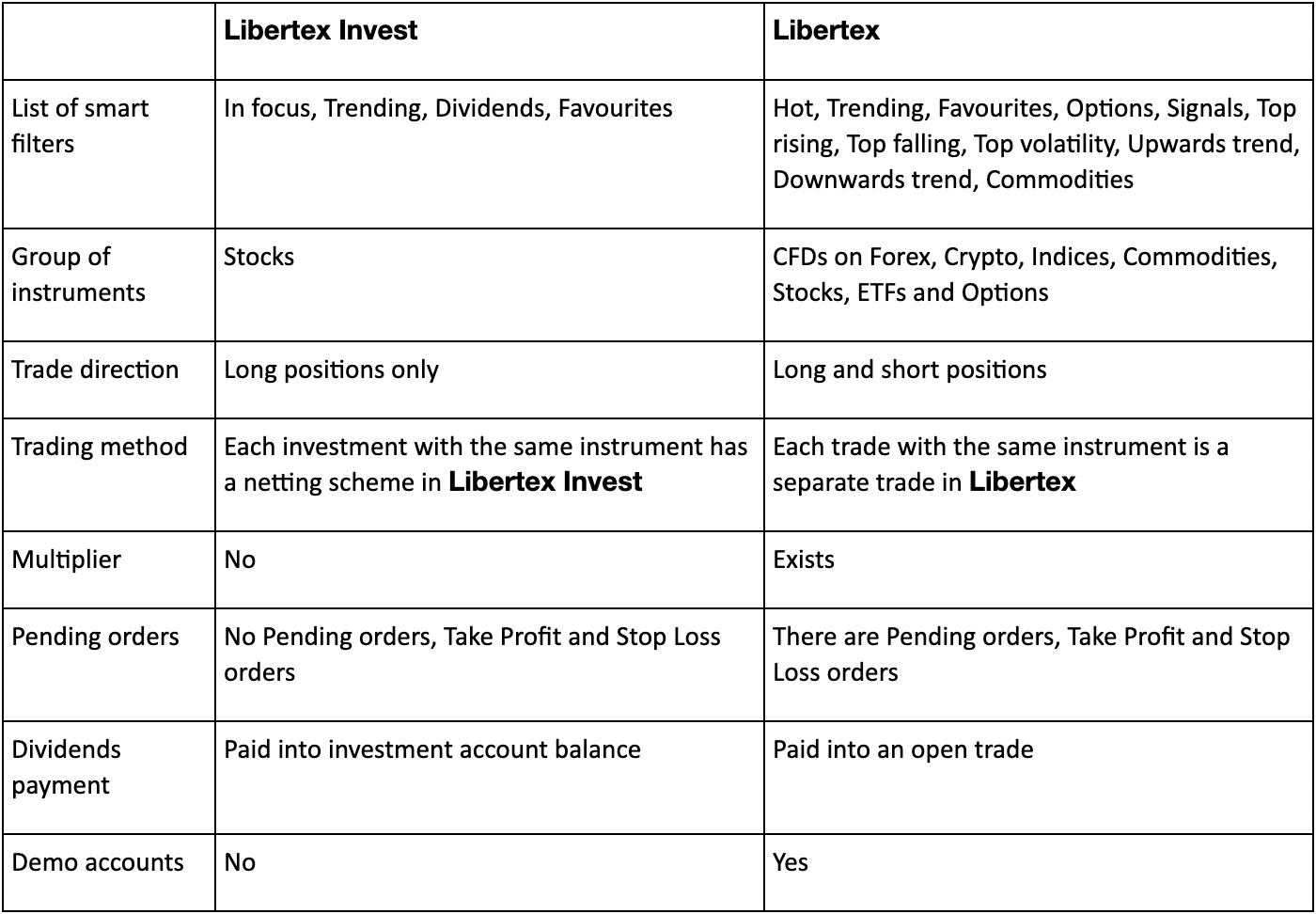

Libertex Account Types

The platform boasts two types of accounts, catering to traders with different experience levels. Whether you are a beginner or an experienced trader, you can find the account type that suits your needs. Let’s take a look at them:

Register for Account

Simply sign up online for a Libertex account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using Libertex's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

Our Take on Libertex

Established in 2006, Libertex Europe stands as a prominent CFD and Stock broker, extending leveraged products and investment avenues to both retail and seasoned traders. Under the vigilant regulation of CySEC, it holds the distinction of being the Official Online Trading Partner of the formidable German heavyweight champions, FC Bayern.

Libertex boasts an impressive array of over 300 CFD underlying assets, encompassing FX pairs, metals, shares, ETFs, options, and more. With its competitive fee structure, diverse account options, and a suite of trading platforms including its flagship Libertex platform, MetaTrader 4, and 5, Libertex ensures accessibility and flexibility for traders of all levels.

The blend of tight costs and an extensive selection of typically volatile underlying assets, such as cryptocurrencies, indices, and shares, renders Libertex particularly conducive for high-frequency trading strategies.

Libertex Pros & Cons

Pros:

- Transparency: Libertex operates with high transparency, providing traders with clear information and processes.

- Competitive Fees: The platform offers very competitive fees, ensuring cost-effectiveness for traders.

- Multiple Trading Platforms: Libertex provides a choice of trading platforms, allowing users to select the one that best suits their preferences and needs.

- Diverse Instrument Selection: With a wide range of tradable instruments, including currencies, metals, shares, and more, Libertex offers ample opportunities for diversification and investment.

Cons:

- Limited Educational Content: Libertex’s educational resources may be lacking, potentially hindering traders’ ability to enhance their knowledge and skills.

Libertex Highlights for 2024

Libertex, regulated by CySEC in Cyprus, stands out as a top-tier broker with transparent legal documentation. It boasts minimal charges for spreads, swaps, and commissions, making it favorable for executing both high-frequency and high-volume trading strategies. With over 300 underlying assets across various classes, traders have a diverse selection to choose from.

Utilizing its proprietary platform alongside the renowned MetaTrader 4 & 5, Libertex caters to different trading styles, whether it’s intraday, swing, or day trading. However, it lacks VPS hosting and integration with third-party tools. Despite this, its customer support is generally reliable during office hours, although live chat is temporarily unavailable but expected to return shortly.

While Libertex offers a handful of educational materials, its news content is more extensive, albeit with a limited scope.

Who is Libertex For?

Libertex boasts an extensive array of highly volatile CFD assets, including cryptocurrencies, indices, shares, and ETFs. This diverse selection presents an opportunity for high-volume/high-frequency intraday traders, as certain instruments offer below-average spreads and commission-free trading. Additionally, longer-term traders can leverage option CFDs to execute both day and position trading strategies.

What Sets Libertex Apart?

Unlike most brokers that offer either STP accounts with floating spreads or ECN accounts with raw spreads and commissions, Libertex provides a unique pricing structure. While it offers commission-free trading on certain asset classes, its fixed commissions, where applicable, are below the industry average. Similarly, its floating spreads are competitive. This makes Libertex stand out in the market with its highly versatile and competitive pricing mechanism.

Is Libertex Safe to Trade With?

With a track record spanning over a decade, Libertex Europe has solidified its position as a leading brand in the European trading sector. As a part of the Libertex Group, which boasts over 26 years of global trading experience, Libertex Europe brings a wealth of expertise to the table.

The company adheres to essential regulatory requirements, including the segregation of client funds, negative balance protection, and the implementation of a ‘best execution policy.’ These factors collectively contribute to Libertex’s reputation as a reputable broker in the industry.

Stability and Transparency

In our assessment of the Trust category, we consider factors such as longevity in the business, company size, and transparency in providing readily available information.

Libertex demonstrates a commendable level of transparency. It offers an extensive range of key trading and investing documents, including its client agreement, best execution policy, and client categorization. Additionally, the broker publishes yearly execution statements, allowing traders to familiarize themselves with Libertex’s execution standards.

Moreover, Libertex prominently displays a risk warning banner at the top of its website. Unlike less reputable brokers that may bury such critical information at the bottom of their websites, Libertex ensures its visibility. This includes acknowledging statistics indicating that over 75% of traders may incur losses.

In summary, based on my findings, Libertex can be considered to have a solid level of trust and stability due to the following factors:

- Regulation and authorization by a top-tier regulatory body

- Compliance with essential regulatory requirements

- High level of transparency regarding trading risks

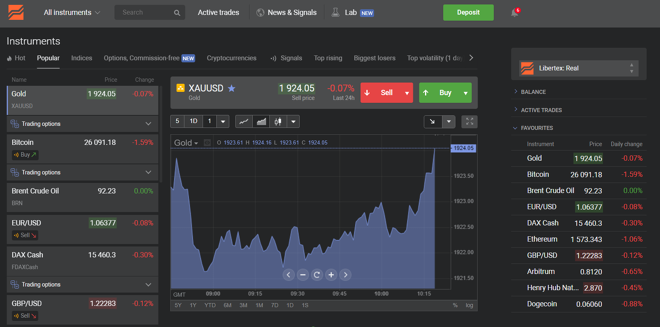

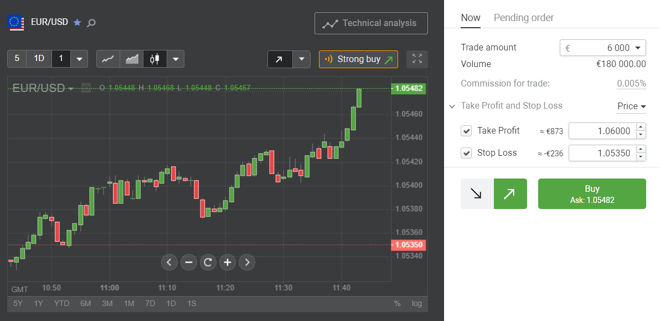

Libertex’s Web Trader Platform

The Libertex platform offers a straightforward user experience with a minimal learning curve. Its layout follows a familiar structure, featuring a watch list of selected instruments on the left side, a central charts window, and account information and settings on the right side.

Navigating the platform is intuitive, allowing users to access various features effortlessly. For example, when accessing the option CFDs list, essential information such as put/call prices, daily percentage change, market conviction, and price change over the month and year are easily discernible.

The chart screen is often deemed the cornerstone of any trading platform, crucial for conducting successful technical analysis. The clarity and comprehensiveness of price action depiction significantly influence decision-making.

A quality chart should offer clear and informative representations of price movements, allowing traders to discern even subtle changes in behavior. Moreover, it should be complemented by a diverse array of technical indicators, drawing tools, and other instruments essential for conducting thorough technical analysis.

My overall impression of Libertex’s chart screen is overwhelmingly positive, offering ease of navigation conducive to in-depth technical analysis.

Here’s a breakdown of the available analytical tools and chart configurations:

43 Technical Indicators: Libertex supports a wide range of technical indicators, including trend-based, volume-based, oscillators, and Bill Williams indicators. These tools aid in studying price action behavior and determining market sentiment, crucial for forecasting future market movements.

50+ Drawing Tools: Drawing tools such as Fibonacci retracement levels and Elliott waves are available for studying repeatable price patterns and identifying key support and resistance levels. Additionally, trend lines, channels, pitchforks, and more are supported, enriching the analysis toolkit.

10 Timeframes: The platform offers a variety of timeframes for analyzing price action across different durations. While multi-timeframe analysis is supported, the absence of lower timeframes below 1 minute may limit the effectiveness of scalping trading strategies.

6 Chart Types: Price action can be depicted in various chart types, including line, bars, area, and multiple candlestick formats. This diversity allows traders to explore potential trading opportunities from different perspectives, enhancing their analytical capabilities.

Here’s a breakdown of the available order types on the Libertex Web Trader:

Market Orders: These orders facilitate immediate entry into the market at the best available price. Upon triggering, they ensure volume filling, although there may be a slight variance between the requested price and the actual fill price.

Limit Orders: A limit order will only execute if the price action reaches the predetermined execution price. This order type allows traders to specify the exact price at which they wish to enter or exit a position.

Stop Orders: These orders are employed to protect open positions by setting a maximum loss limit in case the market moves unfavorably. If triggered, stop orders help mitigate potential losses by closing the position at a predetermined price level.

My Key Takeaways After Testing Libertex on the Libertex Web Platform

During my trial run of the Libertex platform, where I executed various intraday positions and a swing trade, I found the interface to be remarkably user-friendly, despite lacking certain key features like one-click trading. Indeed, the platform’s intuitive design caught my attention from the moment I opened it.

As a high-frequency trader, I value platforms that offer versatility and the freedom to analyze even the smallest price movements. In my experience, Libertex is particularly well-suited for novice chart analysts who focus on intraday setups, such as breakouts and breakdowns from significant support and resistance levels. Moreover, it caters to traders engaged in longer-term swing, day, and position trading strategies.

Libertex’s Mobile App

Libertex’s mobile app provides traders with convenient access to the market while on the move. It proves invaluable for monitoring the performance of active positions and making necessary adjustments promptly. Given the dynamic and volatile nature of the market, staying informed with the intuitive and user-friendly Libertex mobile app is essential.

The app supports trading CFDs and investing in real stocks, allowing users to place market, limit, and stop orders, as well as adjust the exposure of open trades. While highly customizable, the app lacks technical indicators or drawing tools. However, this limitation isn’t significant, as conducting technical analysis on small-resolution devices is generally not recommended.

For comprehensive technical analysis, I recommend utilizing wide-screen desktop or web trader platforms.

My Key Takeaways After Testing Libertex on the Libertex Mobile App

As a trader who typically avoids using mobile apps due to their limited functionality, I must say that Libertex’s app surpasses my expectations. Despite the challenge of presenting complex information on a small screen, the app effectively maintains the flexibility and practicality of its desktop counterpart.

While I usually refrain from relying heavily on mobile apps for complex technical analysis, Libertex’s app still provides a thorough understanding of price action behavior. During my use of the app over several days, I found it remarkably convenient.

The Bottom Line

Headquartered in Cyprus, Libertex Europe also maintains a representative office registered with BaFin in Germany. Established in 2012, this CySEC-regulated broker has risen to prominence as one of the leading names in the European trading sector over the past decade. With over 300 CFD underlying assets and 300 real stocks available for investment, Libertex offers a diverse range of trading opportunities.

A standout feature of Libertex is its competitive pricing mechanism. The broker imposes low-to-average commissions (starting from 0.0003%), and certain asset classes such as energies, indices, and shares can be traded commission-free. Additionally, Libertex offers very low floating spreads starting from 0.1 pips.

Libertex provides users with a highly customizable and user-friendly web trader platform and mobile app, complemented by the beginner-friendly MetaTrader 4 & 5 platforms. However, the absence of third-party tools is notable.

While Libertex offers diverse in-house educational materials, the lack of third-party content, such as Autochartist, limits alternative perspectives. Moreover, the platform’s educational content is relatively sparse.

Despite these drawbacks, Libertex’s selection of platforms and competitive trading fees make it an attractive option for both novice and experienced traders. Whether implementing high-frequency trading strategies in the short term or longer-term swing and day trading strategies, traders can benefit from Libertex’s offerings.