IG Group Holdings plc, known as IG Group, is a UK-headquartered online trading provider. It provides access to spread betting and CFD trading, enabling traders to speculate on the movements of equities, bonds, and currencies without the necessity of owning the underlying assets.

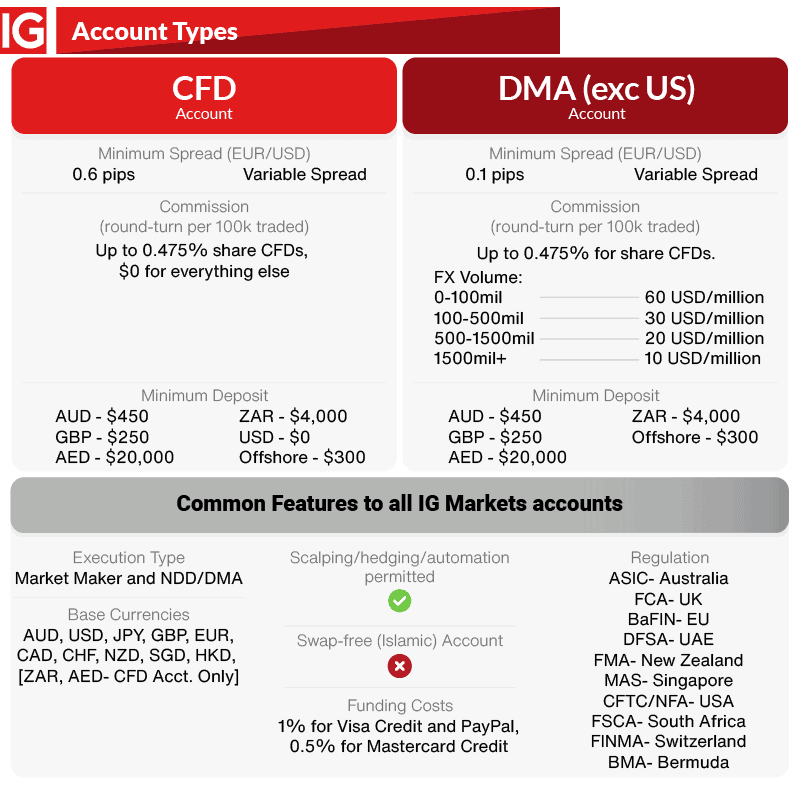

IG Account Types

The platform boasts two types of accounts, catering to traders with different experience levels. Whether you are a beginner or an experienced trader, you can find the account type that suits your needs. Let’s take a look at them:

Register for Account

Simply sign up online for a IG account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using IG's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

IG pros & cons

Pros:

- Established in 1974, IG Group is publicly traded (LON: IGG) and operates under regulation in eight Tier-1 jurisdictions, two Tier-2 jurisdictions, and one Tier-4 jurisdiction.

- IG was awarded the prestigious title of #1 Overall Broker in the ForexBrokers.com 2024 Annual Awards.

- IG boasts the highest Trust Score in independent databases and was recognized as the most trusted broker for forex and CFDs in 2024.

- In 2024, IG excelled in Offering of Investments (with over 19,000 tradeable instruments), Platforms & Tools, Commissions & Fees, and Professional Trading.

- IG’s acquisition of tastytrade for $1 billion introduced options trading and listed-derivatives (i.e. futures) trading to U.S. clients.

- Apart from IG Smart Portfolios and share-dealing, IG offers listed derivatives, including options and futures trading in the U.S. and Europe, alongside forex and CFD trading (and Spread Betting for U.K. clients).

- As of its 2023 annual report, IG holds more than double the required regulatory capital, boasting a $498 million capital headroom buffer as of May 31, 2023.

Cons:

- Although IG’s industry-leading web platform is commendable, its lack of predefined layouts may require some manual configuration.

- Despite offering premium MT4 add-ons from FX Blue and Autochartist integration, IG’s MetaTrader offering still provides access to barely 80 tradeable instruments.

- While IG’s flagship platforms are lauded, MT5 is not yet available.

Is IG safe?

IG is highly regarded for its trustworthiness, boasting an exceptional overall Trust Score of 99 out of 99. As a publicly traded company, IG operates under stringent regulations and also functions as a regulated bank. It holds authorization from eight Tier-1 regulators, which are recognized for their high level of trustworthiness. Additionally, IG is authorized by two Tier-2 regulators, maintaining a reputable level of trust. It’s worth noting that IG operates under the oversight of zero Tier-3 regulators, indicating a low trust level, and one Tier-4 regulator, which signifies a higher risk environment. The Tier-1 regulators include the Australian Securities & Investment Commission (ASIC), Japanese Financial Services Authority (JFSA), Monetary Authority of Singapore (MAS), Swiss Financial Market Supervisory Authority (FINMA), Financial Conduct Authority (FCA), Financial Markets Authority (FMA), Commodity Futures Trading Commission (CFTC), and is regulated in the European Union through the MiFID passporting system.

Offering of investments

Below is a summary of the various investment products offered to IG clients:

| Investment Product | Availability | Details |

|---|---|---|

| CFDs | Available globally | IG provides access to nearly 20,000 Contract for Difference (CFDs) across various markets. |

| Exchange-Traded Securities (non-CFDs) | UK, Germany, Australia | Residents of these countries can access international stock exchanges through IG’s share trading account. |

| Forex Options | Global, excluding the UK | IG offers forex options trading to clients worldwide, except for residents of the UK. |

| Turbo Warrants | Europe (MTF Spectrum) | Exchange-traded Turbo warrants are available through Spectrum, IG’s Multilateral Trading Facility in Europe. |

| Listed Derivatives | US (via tastytrade), Europe (via IG) | IG provides access to listed derivatives in the US through tastytrade and in Europe through its platform. |

| IG Bank | Switzerland | Eligible clients have the option to use IG Bank in Switzerland for their trading needs. |

| Cryptocurrency CFDs | Available globally, excluding UK | IG offers cryptocurrency trading through CFDs but does not support trading the underlying asset directly. |

| Cryptocurrency Derivatives | Not available for retail traders in the UK | Crypto derivatives are not offered to retail traders in the UK. |

Please note that the availability of these investment products may vary depending on the regulatory entity under which the IG account is held. Residents of the UK, New Zealand, Japan, and the US must choose their respective local IG entity.

Commissions and fees

IG’s extensive size enables it to offer scalable execution across various trading products, irrespective of the traded asset. The company provides multiple execution methods, extending beyond the market maker option featured in its standard account. While IG may not be classified as a discount broker, it stands out for its active trader pricing available through its Forex Direct accounts, along with its capacity to execute large orders efficiently.

Forex Direct Account: IG’s Forex Direct account presents spreads closer to the industry average in 2024. During July 2023, spreads averaged 0.62 pips, or an all-in cost of 0.82 after incorporating a per-trade commission equivalent of 0.2 pips.

CFD Account Average Spreads: For both mini and standard-size contracts, typical spreads during the main trading session averaged 0.69 pips in July 2023, slightly better than the industry average. However, during low-liquidity times, spreads can be higher than normal, averaging 1.03 pips during the remaining hours of the trading day. The average spread for IG globally in July 2023, encompassing all trading sessions, was 0.98 pips.

CFD Account Active Trader Rebates: IG offers pricing discounts to volume traders who qualify as professionals under EU rules through its three-tier active-trader rebate program. Rebates range from 10% for trading over £50 million worth of forex volume per month to as much as 20% for trading over £300 million per month.

DMA Account (Forex Direct): For traders seeking significant discounts beyond what the CFD account offers, the DMA account, available through Forex Direct, is an attractive option. This commission-based offering utilizes the L2 Dealer platform and requires a minimum of £1,000. The pricing scale is tiered based on the trader’s previous month’s trading volume.

DMA Account Average Spreads: With average spreads of 0.62 on the EUR/USD for July 2023, the all-in spread is based on the commission paid. Traders doing less than $100 million per month pay a base tier of $60 per million, while those exceeding $1 billion in volume see their per-side commission drop to $10 per million ($20 round-turn), resulting in an effective spread of 0.82 pips.

Mobile trading apps

IG’s mobile app, IG Trading, stands out as a top competitor in the industry and secured the prestigious title of #1 Mobile App in our 2024 Annual Awards. It offers an array of features catering to both novice and experienced traders. Particularly noteworthy are the charts within IG’s app, which are lauded for their extensive range of features.

App Overview: IG provides two trading apps: the widely-used MetaTrader 4 (MT4) app and its flagship mobile app, IG Trading (also known as IG Forex). Additionally, there’s the IG Academy app for educational purposes and IG Access for account security, although neither supports trading directly. The IG Trading app boasts a well-designed interface packed with features such as alerts, sentiment analysis, and highly advanced charts. Research tools include news headlines from Reuters, signals from Autochartist, and PIA First.

Ease of Use: IG’s mobile app strikes a good balance between user-friendliness and depth of features. Navigating between integrated news headlines from Reuters, market analysis, and trading signals is seamless on IG’s app.

The only downside is the absence of predefined watchlists or screeners, making it slightly challenging to navigate IG’s extensive product list. However, the charting features excel on mobile, syncing seamlessly with the web platform. While syncing watchlists are available, it’s worth noting that trend lines do not sync as they do on SaxoTraderGO from Saxo. Nevertheless, there’s much to appreciate about the IG mobile app.

Charting: IG’s mobile app boasts a rich selection of charting tools, including 30 technical indicators, 20 drawing tools, and 16 selectable time frames across five different chart types – even offering tick charts. Setting up charts is straightforward, and zooming in and out across various time frames feels intuitive and precise. While chart indicators added on the web platform don’t automatically sync with the mobile app, they can be saved as presets. Overall, using IG Mobile’s charts is a delightful experience.

Marker research

IG offers an extensive array of high-quality market research from both internal and external sources. The abundance of content available on IG’s platform, including in-house broadcasts via IGTV, contributed to its recognition as the recipient of our 2024 Annual Award for #1 Research.

Research Overview: IG’s research tools encompass streaming news and TV from Reuters, trading signals, in-house broadcasting through IGTV, an economic calendar, and a weekly forecast series titled “The Week Ahead” available in both video and article formats. Additionally, multiple daily blog updates provide detailed market analysis. IG delivers 10 hours of daily live programming as part of its comprehensive coverage of global markets.

Advanced Tools: IG offers a customizable screener for various asset classes, including CFDs on global stocks and forex. The innovative “Recommended News” section personalizes content based on individual account traits. Moreover, the integration of DailyFX content further enhances the research offerings provided by IG.

Market News and Analysis: IG integrates Autochartist and PIA First into its platform, enabling traders to access trade signals generated by automated pattern recognition and technical analysis. These trading ideas can be easily executed with a single click, streamlining the trading process. Additionally, multiple daily articles and videos are posted throughout the trading week to keep traders informed.

DailyFX and IG Community: IG powers DailyFX, a blog-style news website that furnishes IG clients with news content and various research tools. The recently launched IG Community, resembling an advanced forum, serves as a social network where over 60,000 users engage. While the content is crowdsourced, IG curates the best research articles, ensuring quality. The platform includes a timeline feature akin to a social network, displaying member actions such as new joins, follows, and comments on threads. Overall, IG’s research offerings provide valuable insights to traders at all levels.

Education

IG, honored with our 2024 Annual Award for #1 Education, stands out as a frontrunner in providing comprehensive educational resources. The platform offers a vast array of material in various formats, including videos, written articles, numerous weekly webinars, and guides from DailyFX. Moreover, IG ensures accessibility to educational content through its dedicated mobile app for education, along with fostering a robust social community boasting over 64,000 members, which provides a selection of crowd-sourced articles.

Learning Center: Educational content is distributed across IG’s website, YouTube channel, and DailyFX offerings. DailyFX provides a structured learning experience with eight trading guides for beginners, five advanced guides, and written materials organized into a well-designed course format with progress tracking. Additionally, there are informative articles covering risk management strategies, beginner topics, and support for multiple languages.

IG Academy: IG Academy offers eight courses categorized by experience level, each comprising nearly a dozen chapters. These interactive courses feature video content, lesson summaries, and quizzes to reinforce learning. Learners also undergo a final quiz to assess their understanding, providing a total score reflecting correct answers.

Videos: IG provides a wealth of archived content and playlists on its YouTube channels, supplemented by in-house broadcasting through IGTV. Featuring multiple weekly webinars and podcasts, IGTV serves as a valuable educational tool. Live sessions, such as the Technical Analysis Masterclass, cover educational topics, with archived webinars conveniently organized by experience level.

IG Community: The IG Community produces curated content, including educational articles and narratives where traders share personal insights, successes, and failures. This community-driven content adds depth to the educational offerings provided by IG.

Room for Improvement: As a leader in educational resources, IG’s offering is already well-rounded. However, there’s potential to consolidate content from the IG Academy mobile app into the main IG Trading app, creating a more streamlined experience. Additionally, expanding advanced material, both in written and video formats, could further enhance the educational value provided by IG.

Final thoughts

For retail forex and CFD traders seeking a trusted broker with exceptional tools, research resources, and access to a wide range of global markets, IG emerges as an outstanding choice.

In 2024, IG excelled across multiple categories, clinching top honors for Offering of Investments, Commissions and Fees, Platform and Tools, Professional Trading, and sweeping first place in Mobile Trading Apps, Beginners, Education, Research, Trust Score, and Overall rankings. Additionally, IG secured prestigious awards for #1 Mobile App (IG Trading), #1 Web Platform, and #1 Forex Options.

In summary, IG stands out as the top pick for 2024, offering a comprehensive suite of features and services tailored to meet the needs of discerning traders in the retail forex and CFD markets.