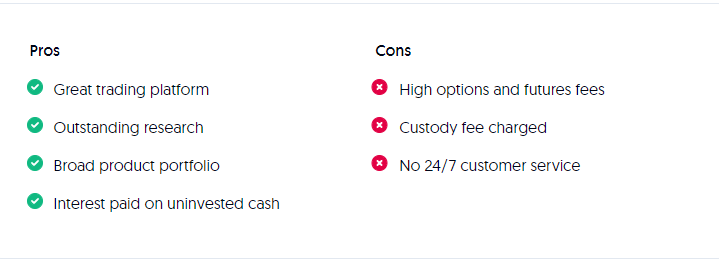

Saxo stands out as a premier multi-asset broker, offering exceptional research capabilities and an outstanding trading platform. With an extensive range of over 70,000 tradable instruments, Saxo caters to the diverse needs of traders. For active traders, Saxo delivers an immersive and feature-rich trading environment, complete with a wide array of tools, research resources, and premium features.

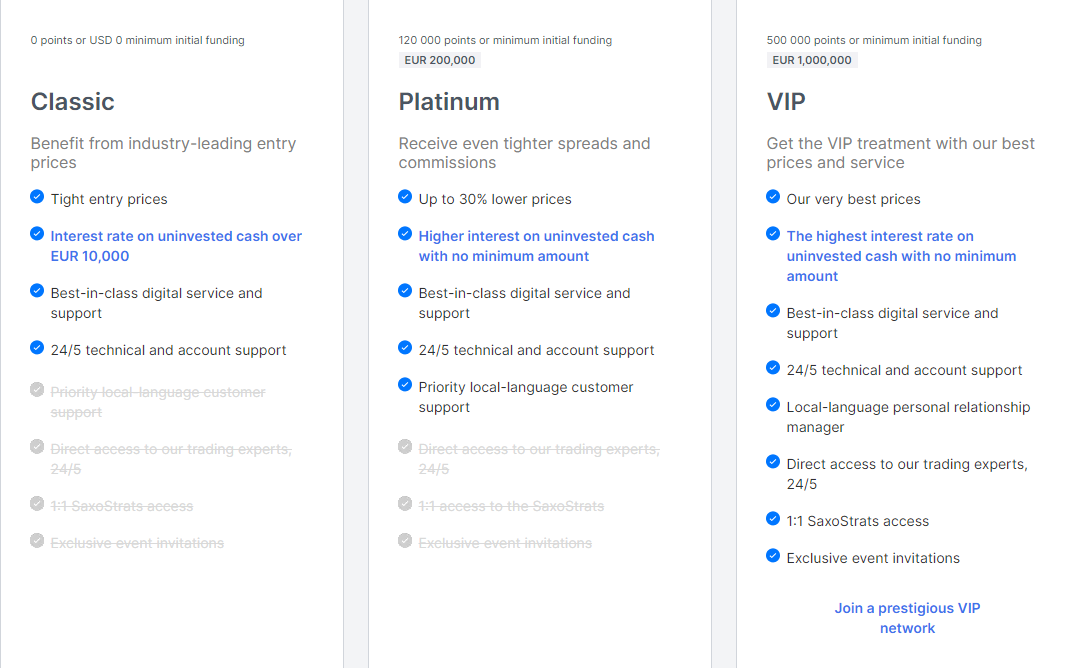

SAXO Bank Account Types

The platform boasts three types of accounts, catering to traders with different experience levels. Whether you are a beginner or an experienced trader, you can find the account type that suits your needs. Let’s take a look at them:

Register for Account

Simply sign up online for a SAXO Bank account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using SAXO Bank's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

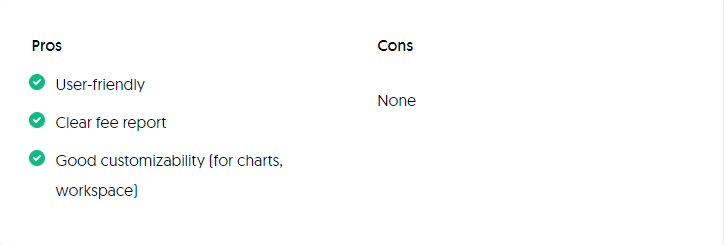

Why choose Saxo Bank

Saxo Bank stands out as a top pick for serious traders, offering one of the highest-quality trading platforms in the industry. Its platform impresses with its sleek and sophisticated design, while remaining user-friendly—a rare combination. Forex traders can take advantage of competitive fees and an extensive selection of currency pairs. However, long-term investors should be aware of Saxo Bank’s custody fees.

Fees

Saxo Bank’s trading and non-trading fees fall within the average range. The fee structure is somewhat diverse, with notable variations among different asset classes. An additional benefit is that Saxo offers interest on uninvested cash, providing an added advantage for investors.

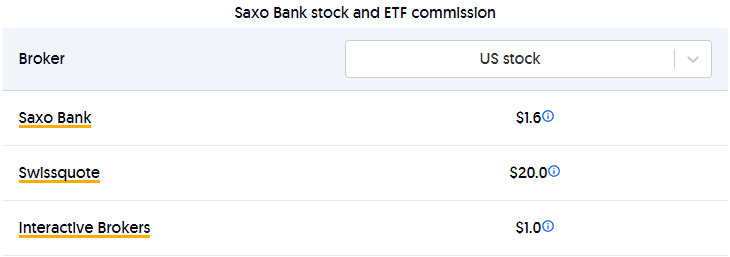

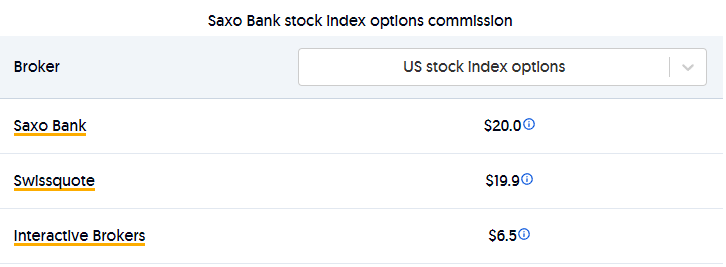

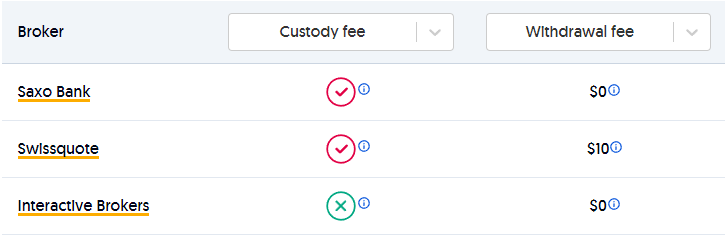

We conducted a comprehensive comparison of Saxo Bank’s fees with two similar brokers, Swissquote and Interactive Brokers. Our selection of these competitors was based on objective criteria such as the range of products offered, client profiles, fee structures, and other relevant factors. Below, you’ll find a detailed analysis comparing Saxo Bank with its alternatives.

Low stock and ETF commission

Saxo Bank’s fees for US stocks are approximately half of the industry average. These fees are calculated based on the trade value, with a minimum commission of $1 or 0.08% of the trade value. However, utilizing VIP pricing, traders can benefit from commissions as low as 0.03% of the trade value with a minimum of $1.

Low FX fees

The spread of 0.8 for EUR/USD includes all fees, meaning there are no additional commissions charged separately.

High options commission

Saxo Bank charges higher fees for US stock index options compared to the industry average. The standard fee is $2 per contract, but VIP pricing reduces it to $0.75 per contract.

In contrast to the majority of brokers, Saxo Bank imposes an overnight holding fee. This fee is determined by the Saxo Offer Financing Rate, augmented by a markup (350 bps for Classic accounts)

High custody fee, no withdrawal fee

The broker charges no account or withdrawal fees, but there is a an inactivity fee that is low.

The application of fees varies depending on your residency status:

For Classic clients in the CEE region, no inactivity fee is imposed if your assets under management (AUM) exceed €10,000. The same exemption applies to Platinum and VIP clients. However, if your AUM falls below this threshold, an inactivity fee of €120 is levied.

Regarding custody fees for holding stocks, ETFs, or bonds, you have the option to avoid this charge by enrolling in the stock lending program, where Saxo can lend out your shares and split the profit 50/50. Custody fees are structured as follows:

- For Classic accounts, there is an annual charge of 0.15% of the value of open positions, with a minimum monthly fee of €5. Fees are computed daily but debited on a monthly basis.

- For Platinum and VIP accounts, the custody fee rates are reduced to 0.12% and 0.09%, respectively, with a minimum monthly charge of €5. Additionally, the custody fee is subject to Value Added Tax (VAT). EU residents are subject to a Danish VAT rate of 25%, while non-EU residents are exempt from VAT.

Furthermore, if you engage in trading assets denominated in a currency other than your account currency, you may incur currency conversion fees. These fees are calculated based on the mid-FX spot rate with a variance of +/-1%. Platinum and VIP clients enjoy lower markup rates of +/-0.75% and +/-0.50%, respectively.

Other commissions and fees

Here’s a breakdown of the fees associated with various trading options:

For mutual fund trading, there are no fees charged by the broker, though mutual funds are only available in specific countries.

When trading US index futures, the fee is $3 per contract, but VIP pricing can reduce this cost to as low as $1 per contract.

Index CFD fees are included in the spread, with the spread for S&P 500 index CFDs set at 0.5.

For stock CFD trading, the commission is $0.02 per share with a minimum of $4. However, with VIP pricing, the minimum commission can be reduced to as low as $1.

Trading US treasury bonds incurs a fee of 0.2% of the trade value with a minimum of €20. With VIP pricing, this fee can be reduced to as low as 0.05% of the trade value, maintaining the minimum charge at €20.

Misc. fees compared with other brokers

Safety

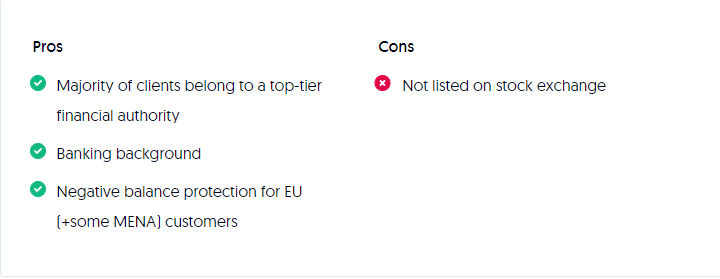

Saxo Bank is regulated by multiple financial authorities, notably the top-tier FCA, and holds a bank license. It provides negative balance protection to its clients. Despite these credentials, Saxo Bank is not publicly traded on any stock exchange.

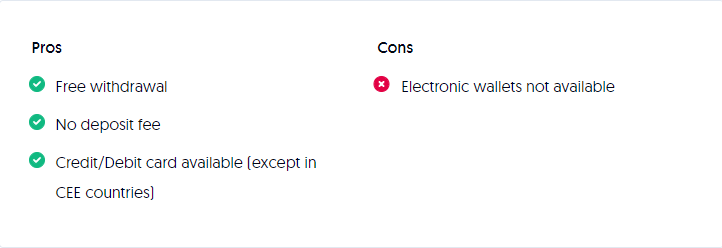

Deposit and withdrawal

Account opening

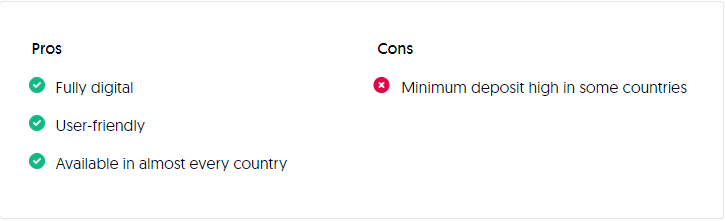

Saxo’s account opening process is entirely digital, designed to be user-friendly, and accessible in a wide range of countries. While there is typically no minimum deposit requirement in most countries, certain regions, such as the MENA region, may have a higher minimum deposit threshold, such as $5,000.

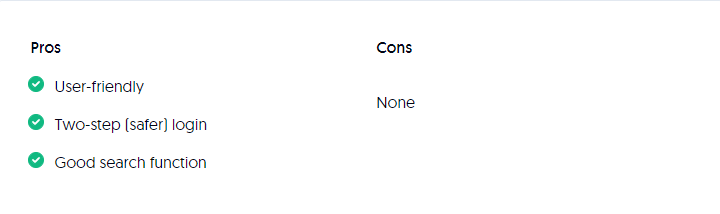

Mobile app

Desktop platform

Product selection

Saxo Bank offers a comprehensive product portfolio that spans across all asset classes and encompasses numerous global markets. However, there is room for enhancement in the selection of mutual funds.