OANDA is widely regarded as highly trusted, boasting an impressive Trust Score of 93 out of 99. While it is not publicly traded and does not function as a bank, it operates under the regulation of seven Tier-1 regulators, indicating a high level of trustworthiness. Additionally, it is subject to oversight by one Tier-4 regulator, suggesting a relatively higher risk level in that jurisdiction.

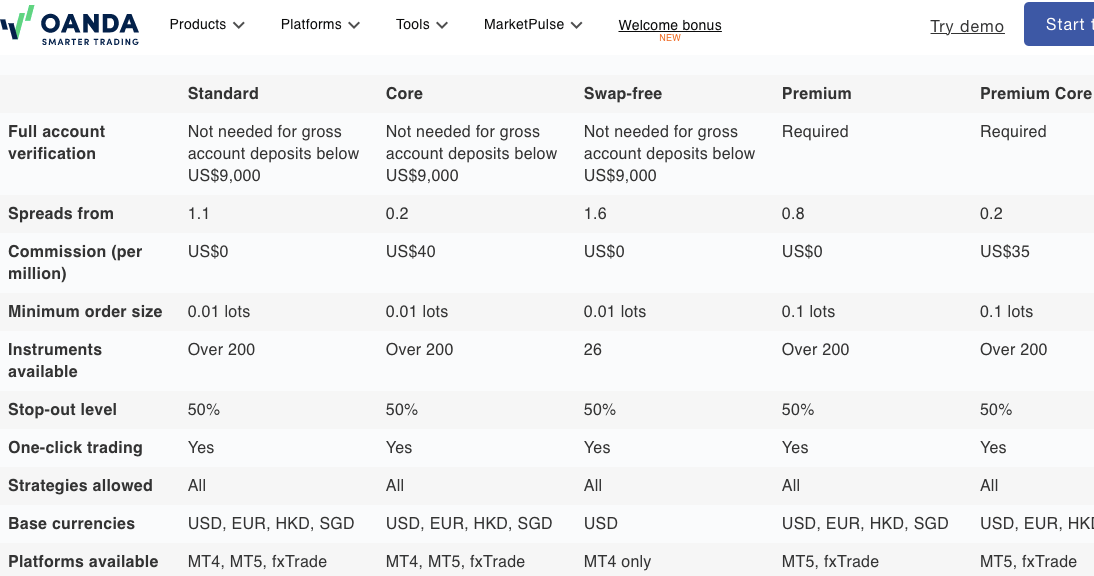

Oanda Account Types

The platform boasts five types of accounts, catering to traders with different experience levels. Whether you are a beginner or an experienced trader, you can find the account type that suits your needs. Let’s take a look at them:

Register for Account

Simply sign up online for a Oanda account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using Oanda's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

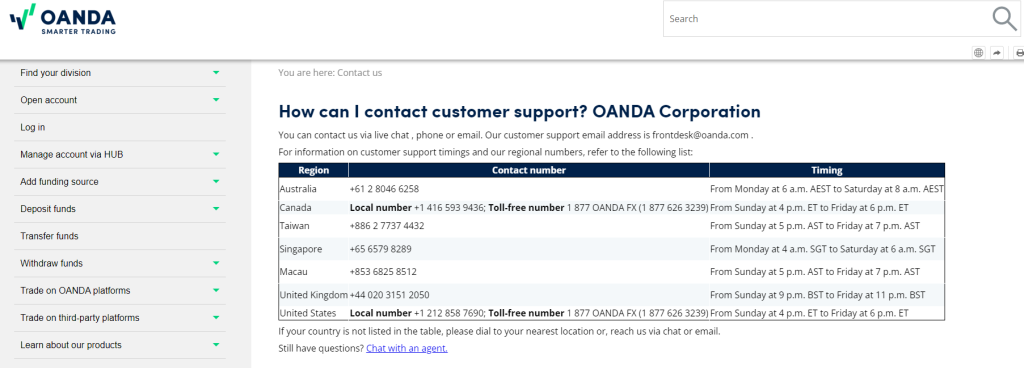

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

OANDA pros & cons

Pros:

- Established in 1996, OANDA is regulated in seven Tier-1 jurisdictions.

- The MarketPulse hub provides high-quality research articles and daily analysis updates.

- OANDA offers its own podcast series, “Market Insight.”

- The OANDA Trade mobile app strikes a balance of features and is highly user-friendly.

- OANDA excels in research tools, news, and market analysis offerings.

- TradingView platform is accessible in certain regions, along with various VPS services for MT4 hosting.

- OANDA provides multiple options for algo trading, including via API through its Algo Labs offering.

- Through a partnership with Paxos, OANDA facilitates access to spot crypto trading (excluding crypto deposits/withdrawals).

- Select OANDA entities offer crypto CFDs in compliance with local regulations.

- OANDA revamped its Advanced Trader program to Elite Trader, offering revised perks and rebate tiers for high-volume traders in the U.S. and Canada.

Cons:

- Offers fewer video market updates compared to competitors.

- Video content is not comprehensive, primarily consisting of platform tutorials.

- OANDA’s spreads are below average, lagging behind discount leaders such as CMC Markets and IG.

- The proprietary OANDA Trade desktop and web trading platform is good but not on par with leading platforms like IG and Saxo.

Is OANDA safe?

Offering of investments

The range of markets accessible at OANDA may slightly vary depending on the regulatory entity overseeing your account. In the U.S., CFD trading is not available. However, in jurisdictions like Australia and the British Virgin Islands, OANDA presents a wide array of 1744 symbols and 71 forex pairs, along with the opportunity to engage in CFD trading for cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. It’s important to note that the availability of tradable symbols differs by region, and individuals are encouraged to consult OANDA’s website for verification of available options in their respective countries or regions.

Cryptocurrency trading at OANDA primarily involves CFDs. Additionally, traders have the option to trade underlying crypto assets, such as purchasing actual Bitcoin, through OANDA’s Paxos account offering. It’s worth noting that crypto CFDs are not accessible to retail traders via any broker’s U.K. entity, nor to U.K. residents, except for Professional clients.

Here’s a summarized table outlining the various investment products available to OANDA clients:

Commissions and fees

OANDA is generally associated with steep trading costs, featuring high effective spreads across its default and core pricing structures compared to top-tier brokers. However, its main advantage lies in its automated execution capabilities across its account offerings.

Spreads: OANDA’s bid/ask spreads, which represent the fees clients incur for trading, are similar to those of FOREX.com and FxPro. While the minimum spread cost may be slightly higher than brokers offering sub-pip spreads, such as less than 1.0 pip, OANDA’s average non-core pricing for the EUR/USD pair was 1.57 pips during September 2023.

Core pricing: OANDA’s core pricing features lower spreads but involves a per-side commission of $5 per $100,000 worth of currency (or roughly $10 per round-turn standard lot). This option requires a $10,000 minimum deposit, and when factoring in the commission, the overall cost is nearly identical to commission-free pricing.

Micro lots: OANDA allows traders to engage in forex trading with a minimum contract size of one unit or 0.001 micro lot, significantly lower than the standard micro lot size.

Elite Trader program: OANDA offers rebates for active traders in certain jurisdictions who trade 10 million or more in volume. These rebates range from $5 to $17 per million, with additional perks such as subscription reimbursements for TradingView Pro, Pro+, and Premium subscribers.

Transparency: OANDA emphasizes pricing transparency by regularly publishing a trailing average of its spreads across various time frames. However, precise comparisons are challenging due to the absence of a fixed-period average spread publication.

It’s important to note that the information provided may vary depending on your country of residence. For instance, data obtained from OANDA’s U.S. entity, the OANDA Corporation, may not apply to residents of other countries. Additionally, certain offerings, such as Crypto CFDs, are available outside the U.S. and U.K. from specific OANDA global entities but are not accessible to U.S. or U.K. retail clients.

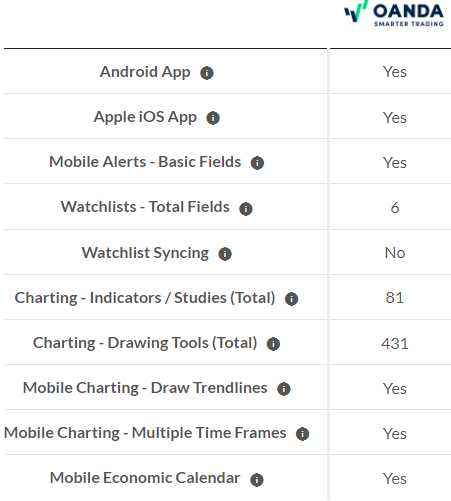

Mobile trading apps

OANDA’s flagship Trade mobile app stands out for its user-friendly interface, quality market research, and robust charting capabilities.

App overview: In addition to offering the popular MetaTrader 4 (MT4) mobile app, OANDA provides its proprietary Trade mobile app, developed in-house.

Ease of use: Navigating the Trade app is simple, with chart access available via a single click on the graph icon in the watchlist. Setting up trades or adding price alerts is straightforward, thanks to the app’s intuitive layout. Furthermore, the Trade app integrates useful features like research from Autochartist and real-time news updates.

One notable feature is the seamless transition from chart viewing to the trade ticket window, allowing users to swiftly execute orders and adjust stop-loss and limit levels with ease.

Charting: The Trade app boasts versatile charting tools, including 33 technical indicators, 13 drawing tools, and various time frame options. Users can enjoy a smooth charting experience, with seamless zooming enabled by the app’s responsive design.

Syncing: While the Trade app excels in usability, it could enhance user experience by introducing watchlist syncing functionality. Additionally, mobile chart indicators currently do not sync with the desktop or web versions of the Trade app. Adding educational and market analysis videos would also be a valuable addition to the app’s offerings.

Other trading platforms

OANDA’s Trade trading platform suite offers strong capabilities in market news and charting, particularly with its integration of TradingView-powered charting. However, it falls short in certain areas, such as the integration of research and trading tools within its desktop and web platforms.

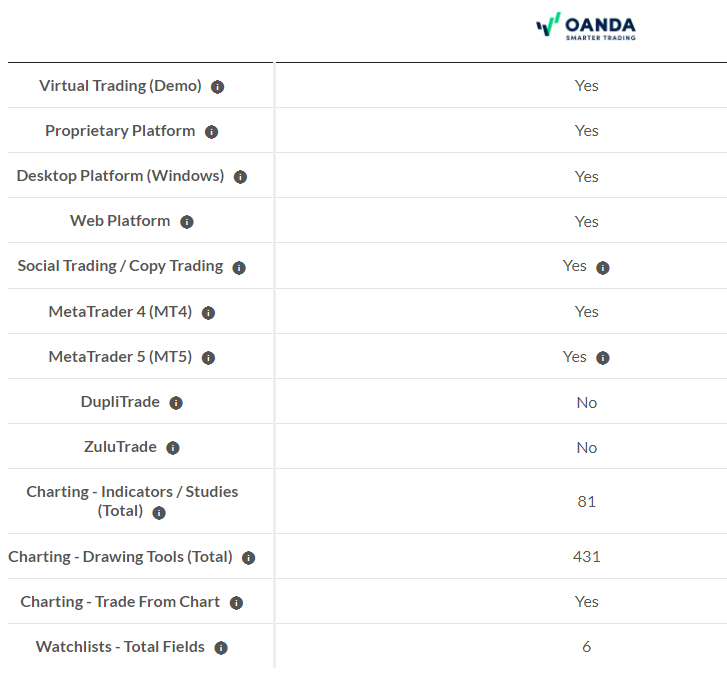

Platform overview: OANDA provides two platform suites: the widely-used MetaTrader 4 (MT4) platform, available for both web and desktop, and OANDA’s Trade web and desktop trading platform. MetaTrader 5 (MT5) is also available in select regions, such as Japan, the U.K., and emerging markets, through OANDA’s BVI entity. However, it is not accessible to U.S. clients.

Charting: OANDA’s Trade platform offers charts powered by TradingView, featuring over 80 indicators and various advanced features. Users can overlay multiple currency pairs within a single chart for comparison. The web-based and desktop versions of the Trade platform are identical, facilitating seamless switching between versions.

However, some integrated features may open in new browser windows, even within the desktop version, which can be distracting. Other brokers integrate these features directly into the platform, enhancing user focus.

Trading tools: OANDA’s Marketplace provides access to additional platforms from third-party developers, such as the Seer Trading Platform, which supports algorithmic trading system development. OANDA also supports trading connectivity with various charting platforms like TradingView, NinjaTrader, MultiCharts, and MotiveWave. Moreover, OANDA’s Algo Labs offers API access with support for multiple programming languages, including Python and C#.

Account management: OANDA’s online account management portal combines several services, allowing users to transfer funds between accounts and access statements with ease.

Market research

OANDA equips forex and CFD traders with a comprehensive array of resources to navigate the markets successfully, including daily articles, podcasts, and research tools. However, one minor inconvenience is that many research resources from the desktop and web platform open in a new browser, rather than being seamlessly integrated within the platform. Additionally, OANDA provides fewer video updates compared to leading competitors like Saxo and IG.

Research overview: OANDA offers a wide range of research resources tailored for forex traders. Its MarketPulse site features a robust selection of articles categorized for easy navigation, with multiple updates published daily. News headlines from reputable sources like Dow Jones Newswire stream directly on OANDA’s MetaTrader 4 (MT4) and Trade platforms. Integration of Autochartist within the broker’s web platform and mobile app offers valuable trading signals and automated technical analysis. Furthermore, OANDA produces a Market Insights series with daily analysis updates.

Market news and analysis: OANDA’s MarketPulse site provides dedicated news, research, and analysis content. The Trade mobile app streams news from Dow Jones along with insights from the company’s blog.

Premium content: OANDA offers access to Dow Jones Select, and traders can utilize third-party technical analysis software from providers like MotiveWave and MultiCharts.

Final thoughts

OANDA boasts a solid regulatory track record, holding licenses in some of the most stringent financial centers worldwide. Its strength lies in robust market research content and an outstanding mobile app. In our 2024 Annual Awards, OANDA secured Best in Class accolades for both Ease of Use and Research. Notably, OANDA’s U.S. brand is regulated in the U.S., distinguishing it as one of the select forex brokers catering to U.S. residents. However, OANDA faces limitations due to its relatively small list of just 124 tradable products and pricing that may not match up to the offerings of the top low-cost brokers.

Thanks to its intuitive web and mobile trading apps, OANDA caters to both casual investors and sophisticated traders. It provides options for those who prefer straightforward trading experiences, as well as advanced tools for users who connect via API or utilize automated trading systems on platforms like MT4.