FP Markets stands out with its intuitive trading platforms, diverse array of tradable instruments, and cost-effective fee structure. Its dedication to educating traders and innovative features like comparative analysis and trend exploration tools further elevate its attractiveness.

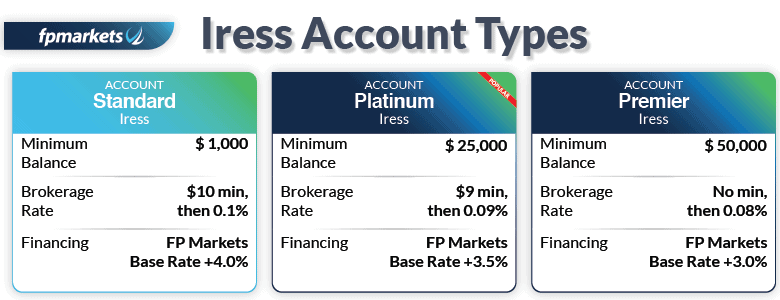

FP Markets Account Types

The platform boasts three types of accounts, catering to traders with different experience levels. Whether you are a beginner or an experienced trader, you can find the account type that suits your needs. Let’s take a look at them:

Register for Account

Simply sign up online for a FP Markets account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using FP Market's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

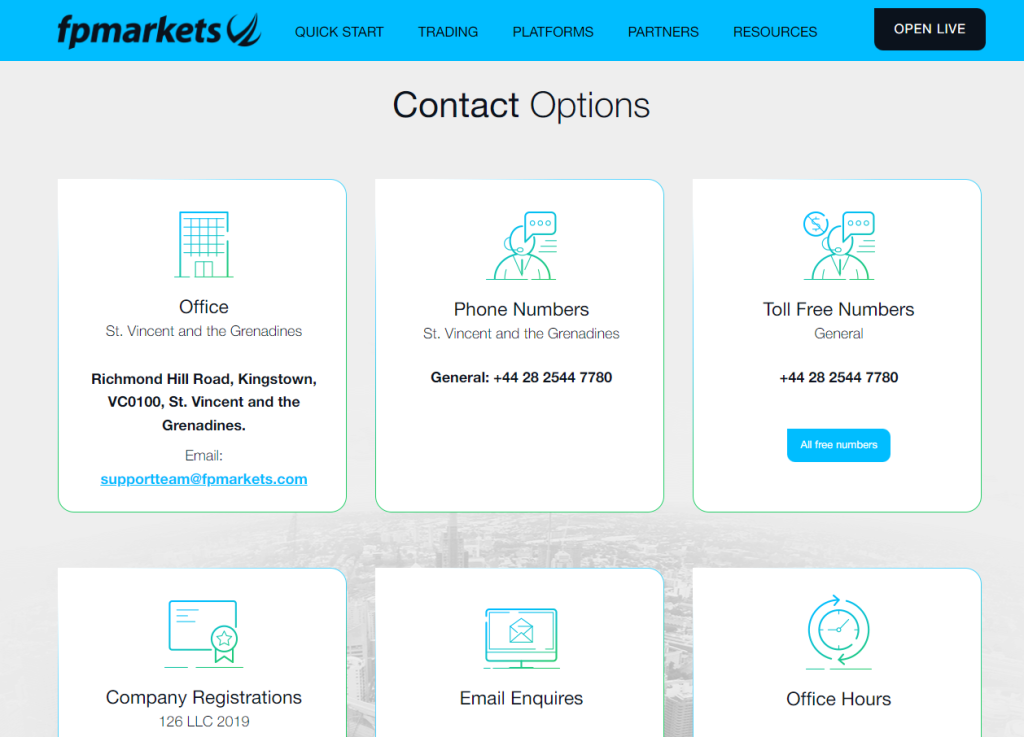

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

Why choose FP Markets

FP Markets, regulated by Australia’s esteemed ASIC, is a leading CFD and forex broker.

Benefiting from low forex fees, FP Markets ensures swift account setup and deposits, facilitating a seamless trading experience. Moreover, the platform offers a robust selection of educational resources including demo accounts and e-books.

While FP Markets specializes in forex, CFDs, and cryptocurrencies, its product range is somewhat constrained. The MetaTrader 4 trading platforms, though functional, sport an outdated design. Furthermore, research tools’ quality varies, particularly in fundamental data, news, and charting capabilities.

FP Markets Pros & Cons

Pros:

- Low forex fees

- Quick and effortless account opening and funding

- Comprehensive educational resources

Cons:

- Limited product portfolio

- Outdated web and desktop platforms

- Lower-quality research tools

Fees

FP Markets boasts low forex and non-trading fees and doesn’t impose an inactivity fee. However, it’s worth noting a significant charge for international bank withdrawals.

Pros:

- Low trading fees

- Low non-trading fees

- Low forex fees

Cons:

- High fee for international bank withdrawals

Low FX fees

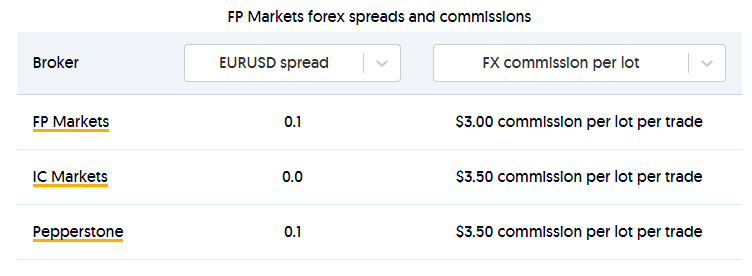

FP Markets applies a forex commission of $3.00 per lot per trade, with additional spread costs on top. For instance, the EUR/USD spread is 0.1.

Low index CFD fees

All index CFD fees are built into the spread. The spread for S&P 500 index CFDs is 0.5.

High stock CFD fees

The commission for stock CFD trading is the following: $0.02 per share, min $15.

Deposit and withdrawal

FP Markets provides a broad selection of deposit and withdrawal options, although certain withdrawal methods may incur fees.

Pros:

- Availability of Credit/Debit card for transactions

- No deposit fees

- Multiple account base currencies offered

Cons:

- Certain withdrawal options may incur fees

Account opening

Opening an account at FP Markets is exceptionally swift and entirely digital. While the minimum deposit for forex trading is reasonable, certain account types necessitate a balance of at least AUD 1,000.

Pros:

- Swift account setup process

- Fully digital

- Low minimum deposit requirement for forex accounts

Cons:

- Elevated minimum balance necessary for CFD/stock accounts

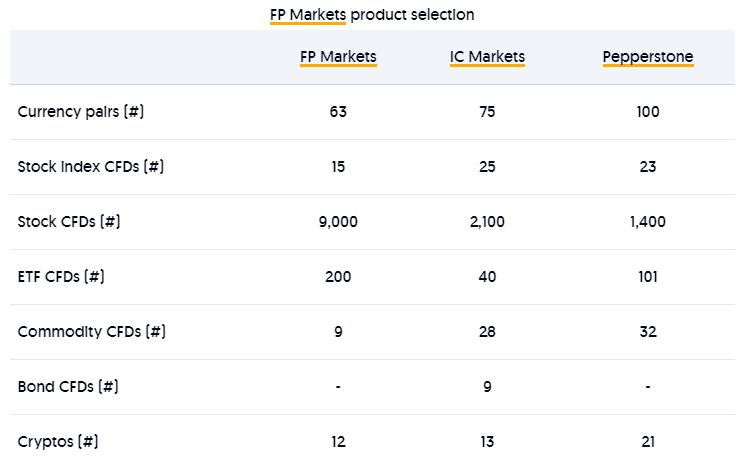

Product selection

FP Markets presents a robust portfolio encompassing CFDs, forex, and cryptocurrencies, alongside Australian real stocks. Notably absent are other asset classes such as stocks beyond the Australian Securities Exchange, ETFs, mutual funds, bonds, options, or futures.

Within its three primary asset classes, FP Markets employs diverse order-routing strategies. Forex trading occurs via ECN, while CFDs utilize DMA for direct market access, resulting in narrower spreads and swifter execution.

FP Markets excels in stock CFDs and ETF CFDs compared to its competitors. While its forex pairs offering is competitive, the selection of stock index CFDs, commodity CFDs, and cryptocurrency CFDs is comparatively limited. Notably, bond CFDs are unavailable. Additionally, futures CFDs for global stock indices are tradable on the platform.