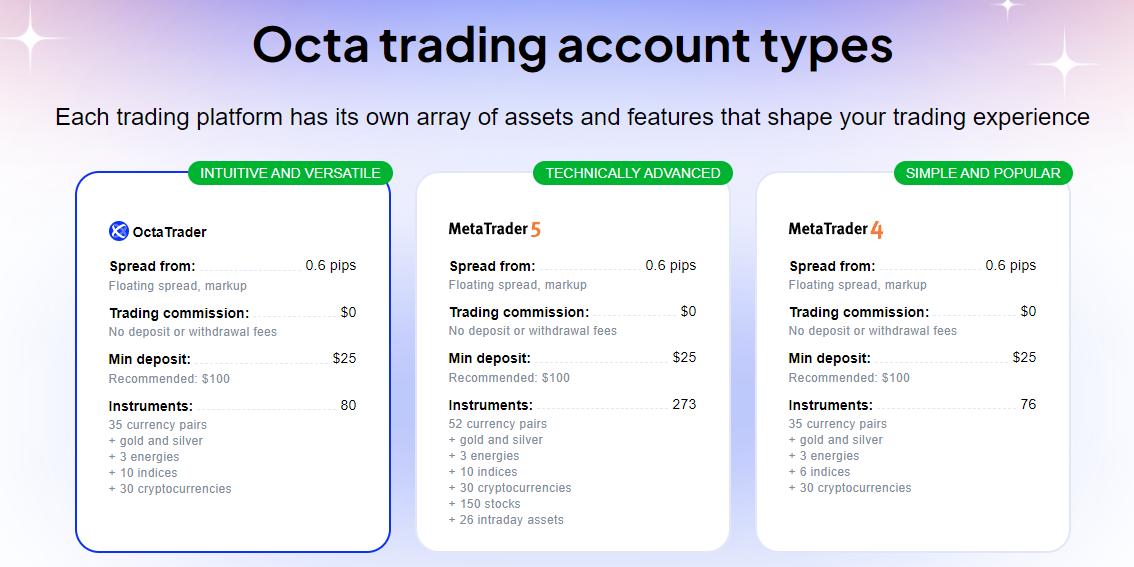

OCTA stands out in fee management, boasting narrow spreads for CFDs on forex and shares. It diverges from the norm in the industry by abstaining from levying swaps or inactivity fees. Across both OctaFX MT4 and OctaFX MT5 trading accounts, all fees are seamlessly integrated into the spread, eliminating the need for additional commissions.

OctaFX Account Types

The platform boasts three types of accounts, catering to traders with different experience levels. Whether you are a beginner or an experienced trader, you can find the account type that suits your needs. Let’s take a look at them:

Register for Account

Simply sign up online for a OctaFX account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using Octa FX's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

Octa pros & cons

Pros:

Established in 2011, Octa operates under regulation in both Tier-1 and Tier-2 jurisdictions, ensuring a strong Trust Score. Provides a comprehensive range of well-structured research materials, including trading ideas, daily updates, weekly forecasts, and third-party content. Offers its proprietary social copy trading platform and the user-friendly OctaTrader web platform. Promotes swap-free and Sharia-compliant trading accounts for clients. Implements tiered margin requirements based on account balance, aligning with industry best practices to safeguard larger investments against overleveraging risks.

Cons:

Clients under Octa’s Mwali entity may not receive the same level of regulatory protection as those in more established jurisdictions. Arbitrage trading is prohibited, and excessive EA requests on MT4 can result in bot bans. While Octa’s trading costs seem competitive, the lack of specified date ranges for listed spreads is a drawback. MT5 offers a limited selection of tradable symbols (just over 230), and OctaTrader platform only supports 80 symbols. Despite ongoing market research development, Octa struggles to match the offerings of leading brokers in this area. The cTrader platform is no longer accessible through Octa.

Is Octa Safe?

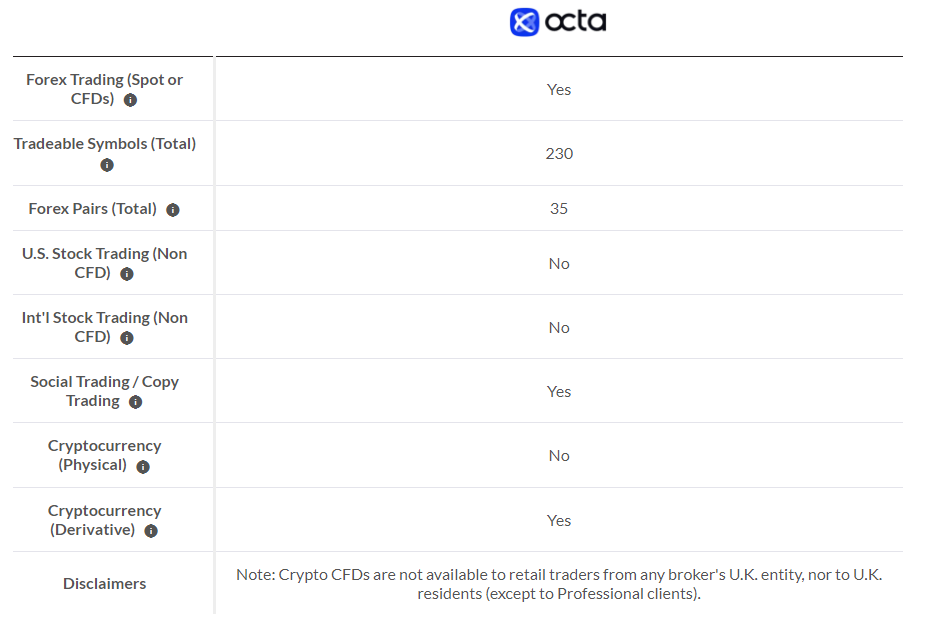

Investment Products

Octa provides access to approximately 230 tradable instruments, with the number varying across its platforms, notably with the largest selection offered on its MT5 platform. In comparison, industry leaders such as Saxo, IG, and CMC Markets offer over 10,000 tradable instruments.

Cryptocurrency trading at Octa is facilitated through CFDs, with direct trading of underlying assets (e.g., purchasing Bitcoin) not available. It’s important to note that Crypto CFDs are not accessible to retail traders via any broker’s U.K. entity, nor to residents of the U.K.

Below is a summary table outlining the products accessible to Octa clients:

Fees

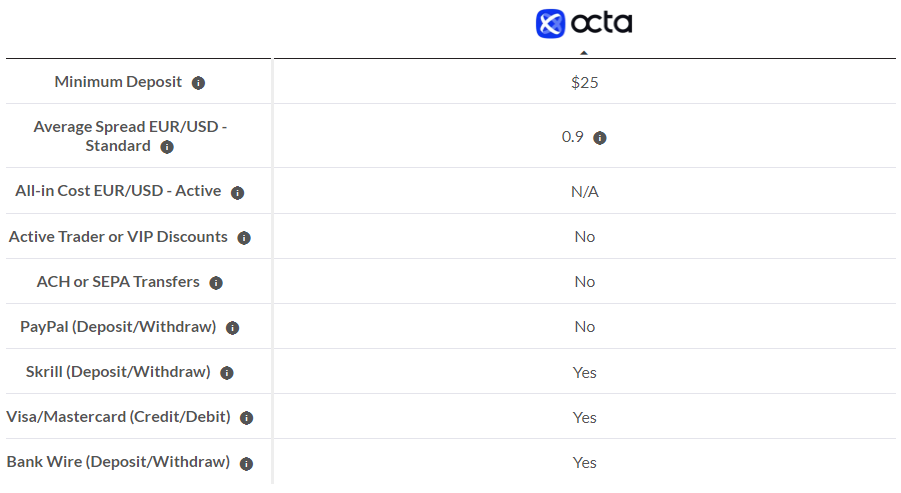

Octa has made significant strides in pricing, narrowing the gap with the most cost-efficient MetaTrader brokers. Notably, it boasts minimal slippage on 97.5% of executed orders and does not incur overnight carry costs. However, restrictions are in place that may pose challenges for high-frequency traders.

When it comes to account types, the commissions or fees you encounter depend on your selected account type and the regulatory entity under Octa. European clients opt for the EU entity, while international clients are served by either South Africa or Octa’s offshore entity in Mwali. In the EU, MT5 is the promoted platform, offering a single account, whereas foreign entities provide accounts for both MT4 and MT5, alongside OctaTrader.

Octa’s spread pricing varies based on the regulating entity of your account. For instance, the EU entity typically offers a slightly better spread for the EUR/USD pair, with an average spread of 0.5 pips, compared to 0.9 pips for foreign entities. It’s important to note that Octa’s website doesn’t specify a date range for its typical spread data, which slightly diminishes the weight of these values. Despite this, Octa has made strides in pricing competitiveness, aligning itself with the lowest-cost MetaTrader brokers. However, without a date range for its average spread claim, an exact comparison is challenging.

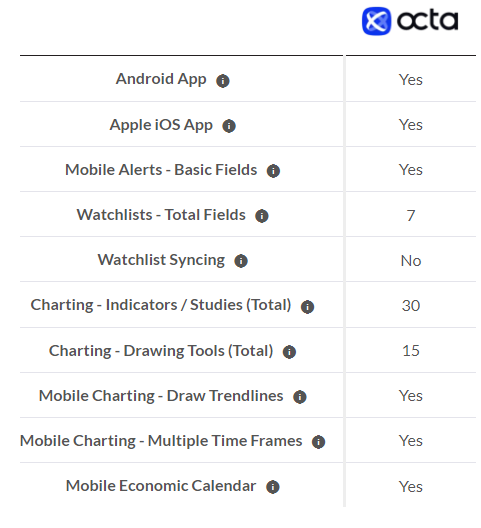

Mobile trading apps

Octa provides traders with mobile app options primarily centered around the MetaTrader platform. Both iOS and Android versions of MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are readily accessible for download from the Apple App Store and Google Play store, respectively. Additionally, Octa offers its proprietary mobile app, Octa Copytrading, designed for social copy trading. Unfortunately, I faced geolocational restrictions on Google Play, preventing me from installing or testing this app. However, it’s worth noting that while Octa’s mobile offerings are robust, they still lag behind those of industry leaders like IG and Saxo.

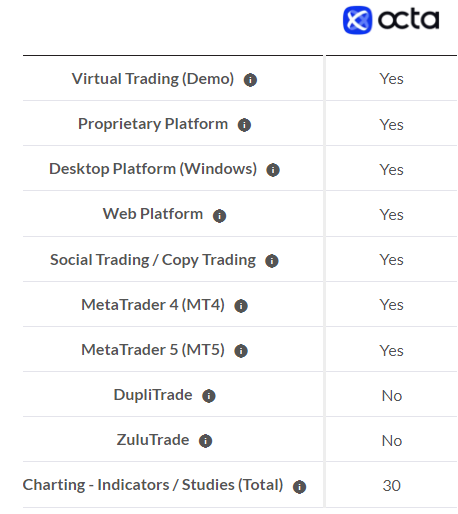

Other trading platforms

Octa primarily focuses on MetaTrader platforms, offering MetaQuotes Software Corporation’s suite, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Although it provides access to its proprietary OctaTrader web trading platform, Octa remains predominantly a MetaTrader broker.

OctaTrader offers a straightforward trading experience, providing essential functionalities without advanced features. Despite making progress over time, such as incorporating research content and enabling trading directly within the chart, OctaTrader still falls short in comparison to the platforms offered by top forex brokers.

In terms of copy trading, Octa offers a web interface that connects to its MetaTrader 4 (MT4) platform. However, the available performance statistics may pose challenges for meaningful comparisons among Octa’s “Masters.” Octa’s copy trading offering lags behind leading brokers in the realm of social copy trading.

Octa’s Copytrading app boasts 2,951 trading systems, or “Master Traders,” available for copying. Recent additions include tools to simplify performance rankings comparison, such as the “minimum expertise” field and risk scores assigned to each trader. While sorting columns from highest to lowest would be beneficial, this feature is currently unavailable on the Master Rating results page.

A key consideration is that past performance does not guarantee future returns. While consistent historical returns may increase the statistical probability, other factors like personal goals, risk tolerance, timing of copying, existing open positions, trader followers, and profit-sharing percentages should also be assessed.

In summary, while Octa offers various tools for copy trading selection, thorough evaluation beyond historical performance is necessary to make informed decisions.

Market research

Octa’s market research is comprehensive and diverse, offering a wide range of content types instead of specializing in any particular field. However, compared to research leaders like IG, Saxo, and CMC Markets, Octa has opportunities to enhance its research offerings.

In Octa’s Market Insights section, you’ll find an economic calendar, daily analysis posts, and automated technical analysis provided by MetaTrader’s Autochartist plugin. Particularly noteworthy are features such as the interest rates tracker, daily and weekly forecast articles, and the economic calendar, which aids in monitoring national holidays and global trading hours.

Octa consistently produces daily articles covering technical and fundamental analysis across popular trading symbols, including forex and CFDs. Additionally, it offers the OC LiveTrader series, featuring live-streamed video content on its YouTube channel, which recently surpassed one million subscribers. While Octa’s research material surpasses that of the average broker, it still lags behind the richer content offered by the leading brokers in this category.

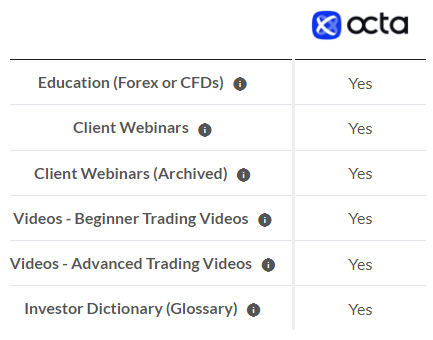

Education

Octa has made significant strides in enhancing its educational resources, now offering webinars, live trading session recordings, and an expanded collection of educational articles and videos. Notably, it has begun producing videos covering advanced topics like Elliot Wave trading.

The Learning Center on Octa’s website features a dedicated forex education section with approximately 20 articles tailored for beginners. Additionally, their YouTube channel hosts archived webinars and the Forex Basic Course video series spanning 11 parts.

Octa’s educational offering is further enriched by features such as a trading glossary, platform tutorials, and an extensive list of Frequently Asked Questions (FAQs). However, there is a noticeable gap in educational content focused on trading strategies and understanding market dynamics. While Octa maintains a blog and a YouTube channel, there is still a desire for more comprehensive educational material.

To further improve, Octa could expand its video content and cover a broader range of topics. Adding written articles and courses would also enhance the educational experience. Additionally, organizing educational content by experience level would provide a more balanced learning journey. Overall, there’s room for growth in Octa’s educational offerings, with potential for deeper organization and broader content coverage. If you’re interested, check out my guide to the best free forex trading courses for additional sources of free forex education.

Final thoughts

Octa provides the complete MetaTrader suite, albeit with a somewhat restricted range of tradable instruments. It’s evident that if Octa aims to compete with the top MetaTrader brokers, it must enhance its product range, research resources, and educational offerings.

While Octa has obtained regulatory approval in Cyprus and South Africa through an intermediary (Orinoco Capital), its Trust Score is notably affected by the absence of additional reputable licenses. Obtaining regulation in more jurisdictions, particularly Tier-1 jurisdictions, will significantly contribute to building trust among current and potential clients.