RoboForex boasts a narrow spread starting from 0 pips, a testament to its commitment to providing optimal trading conditions. This advantage is facilitated by the platform’s direct connectivity to liquidity providers within ECN systems. Traders benefit from instantaneous market order executions, free from any delays stemming from the broker’s servers or platform.

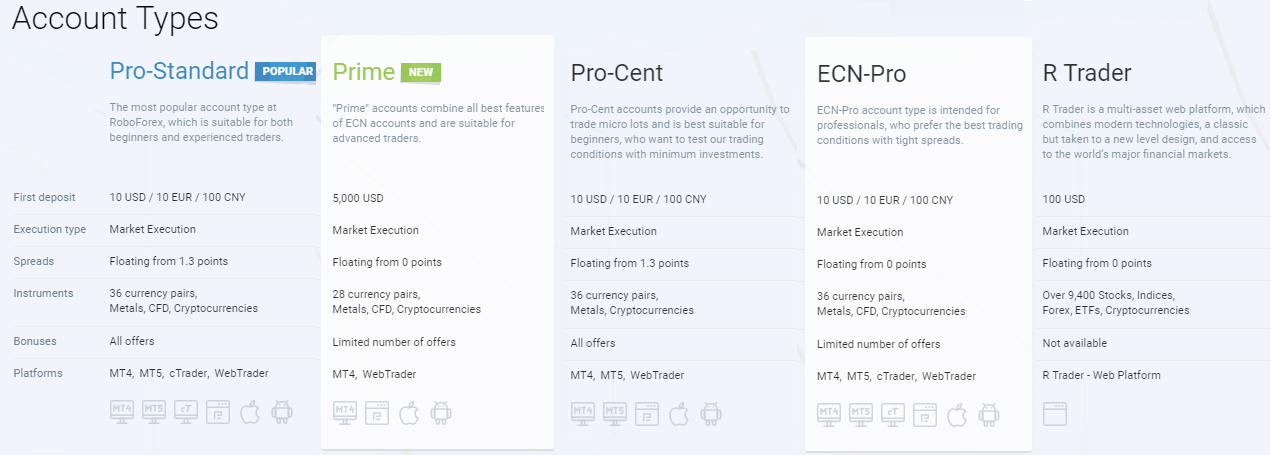

RoboForex Account Types

The platform boasts five types of accounts, catering to traders with different experience levels. Whether you are a beginner or an experienced trader, you can find the account type that suits your needs. Let’s take a look at them:

Register for Account

Simply sign up online for a RoboForex account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using RoboForex's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

- Availability of favorable trading conditions and a minimum deposit

- Unique investment program CopyFx

- Highest affiliate payments: up to 84% of the fee paid by the referral

- Market launch – STP and ECN

- Instant withdrawal of funds

- Minimum deposit – $10

- A small number of currency pairs – 36, for accounts: Pro, Pro-Cent, ECN , Prime

- Lack of tools when trading on the R StocksTrader platform

Why is it Important to Know Where Your Broker’s Subsidiaries are Regulated?

Brokerages often operate across multiple jurisdictions to cater to clients worldwide, but not all regulatory licenses offer the same level of protection. It’s crucial for traders to understand the safety measures provided by a brokerage before opening an account. Here are key safety mechanisms to consider:

Segregation of Client Funds: This practice ensures that client funds are kept separate from the broker’s own capital, reducing the risk of errors. For instance, RoboForex implements segregation of client funds to maintain financial integrity.

Negative Balance Protection: This safeguard prevents trading losses from exceeding the funds in the trading account. It’s particularly vital during volatile market conditions. RoboForex, for instance, offers negative balance protection, limiting potential losses to the amount deposited in the account.

Compensation Scheme: In the event of the broker’s insolvency, a compensation scheme provides a safety net for traders. For example, as a member of the Financial Commission, RoboForex offers insurance coverage of up to 20,000 EUR under its compensation scheme. Additionally, it has implemented Civil Liability insurance for added protection, covering up to 2,500,000 EUR.

Maximum Leverage: Limiting the maximum leverage helps control traders’ market exposure, mitigating the potential for significant losses. Higher leverage ratios amplify both profits and losses. RoboForex offers a maximum retail leverage of 1:2000 with its Pro and ProCent accounts.

Considering these safety mechanisms when choosing a broker is essential for protecting your investments and ensuring a secure trading environment.

Is RoboForex Safe to Trade With?

While RoboForex operates under regulation from a third-tier financial authority overseas, it has implemented robust safety measures to protect its clients’ funds. Unlike many offshore brokers, RoboForex offers negative balance protection, shielding traders from losses exceeding their account balance. Moreover, the brokerage stands out by participating in the Financial Commission and its compensation scheme, providing an avenue for external complaint resolution—a rarity among offshore brokers. Additionally, RoboForex has taken the extra step of obtaining civil liabilities insurance.

Regular audits, both internal and external, ensure transparency and accountability within the company. Furthermore, RoboForex adheres to stringent execution standards, as evaluated by VerifyMyTrade. Each month, the broker submits 5,000 depersonalized client trades for analysis, allowing for comparison with other industry results and benchmarks.

Considering these measures, it’s reasonable to regard RoboForex as a highly secure option for trading. In fact, the safeguards it offers are comparable to those provided by brokers regulated in Europe, instilling confidence in traders regarding the safety of their investments.

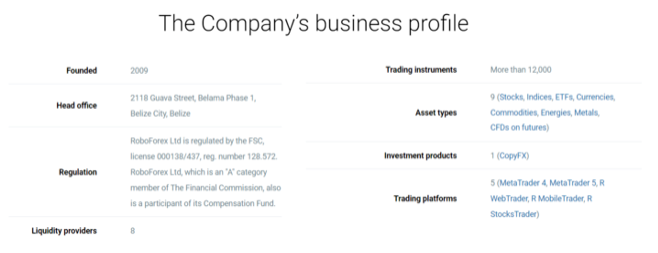

Stability and Transparency

In our evaluation of the Trust category, we assess factors such as stability and transparency. This includes considering the broker’s longevity in the industry, the size of the company, and the availability of transparent information.

RoboForex has disclosed access to a liquidity pool consisting of 8 providers. This extensive pool is expected to contribute to improved and more stable execution standards for traders.

After thorough examination of RoboForex’s legal documents, website details, and overall features, I found the broker to be notably transparent, devoid of any significant red flags. Key business information, such as its registration location, the number of liquidity providers, and auditing entities, is readily available on its website.

In summary, my research suggests that RoboForex exhibits a commendable level of trust and stability, attributable to the following factors:

- Regulation and authorization by the FSC

- Provision of civil liabilities insurance

- Membership in the Financial Commission

- Overall transparency in its operations

- Regular auditing procedures

Fees

RoboForex’s Trading Fees

RoboForex’s Spreads

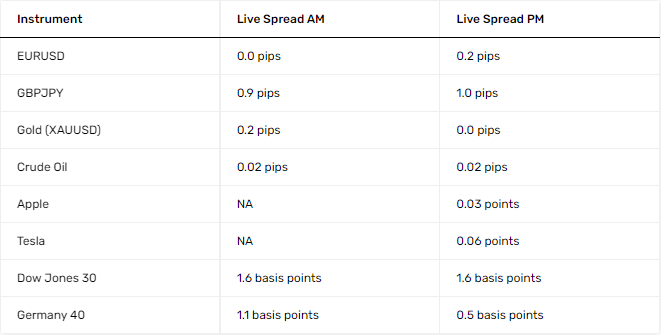

I conducted a test on RoboForex’s spreads during two key trading periods: the London open at 8:00 a.m. GMT and just after the U.S. open at 2:45 p.m. GMT. This assessment took place on October 10, 2023.

My findings reveal that RoboForex maintains spreads that are consistently lower than the industry average across major asset classes. Moreover, it offers exceptionally favorable conditions for trading gold and oil. Notably, trading gold comes with highly advantageous terms, as the corresponding commission ($1 single turn, per lot) is below the industry average.

Research

I have broken down RoboForex’s different types of research content below:

Market Analysis & Research

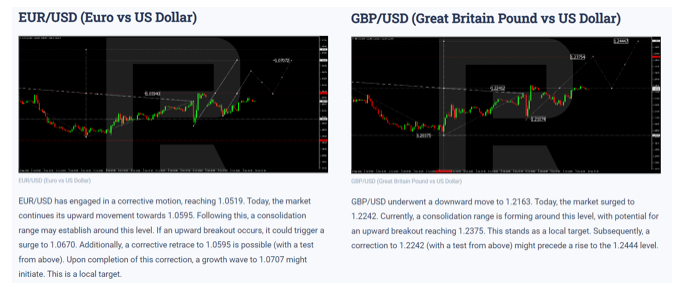

These resources are accessible through the blog section of the website, offering a variety of research content categorized into fundamental analyses, technical analyses, Japanese candlesticks, Fibonacci retracements, and more. The majority of these materials heavily rely on technical analysis, which I find particularly appealing. I appreciate the inclusion of multiple supporting charts with each trading setup, providing insights from various perspectives. This approach is especially useful for examining setups such as reversals and rebounds, analyzing support and resistance levels, channel boundaries, specific patterns, and more.

The Bottom Line

RoboForex stands out as a well-rounded and sophisticated offshore-regulated broker, offering derivatives trading solutions to both retail and professional traders. Founded in 2009 and headquartered in Belize, it boasts two notable features. Firstly, despite its offshore regulation by the FSC of Belize, the broker provides private indemnity insurance and is a member of the Financial Commission, ensuring an added layer of security. Secondly, RoboForex undergoes regular internal and external audits, with its execution standards evaluated by an independent entity, enhancing its trustworthiness. Additionally, RoboForex distinguishes itself with its low trading fees.

The broker offers a practical trading platform, R StocksTrader, alongside the popular MetaTrader 4/5. Its diverse account types cater to various trading systems, including automated and copy trading. Furthermore, RoboForex provides sophisticated research and educational content.

However, one drawback of RoboForex is its relatively slow execution speeds, averaging above 150 milliseconds. Such speeds may not be suitable for high-frequency trading strategies like scalping. Nevertheless, RoboForex mitigates this issue by offering free VPS hosting, which can enhance execution performance to some extent.