Tickmill boasts a strong reputation, earning an impressive Trust Score of 86 out of 99. While it isn’t publicly traded nor operates as a bank, it holds authorization from two Tier-1 regulators, marking it as Highly Trusted. Additionally, it’s authorized by one Tier-2 regulator, indicating a Trusted status. However, there’s a High Risk association as it’s regulated by one Tier-4 regulator, but overall, it’s considered a reliable entity in the financial landscape.

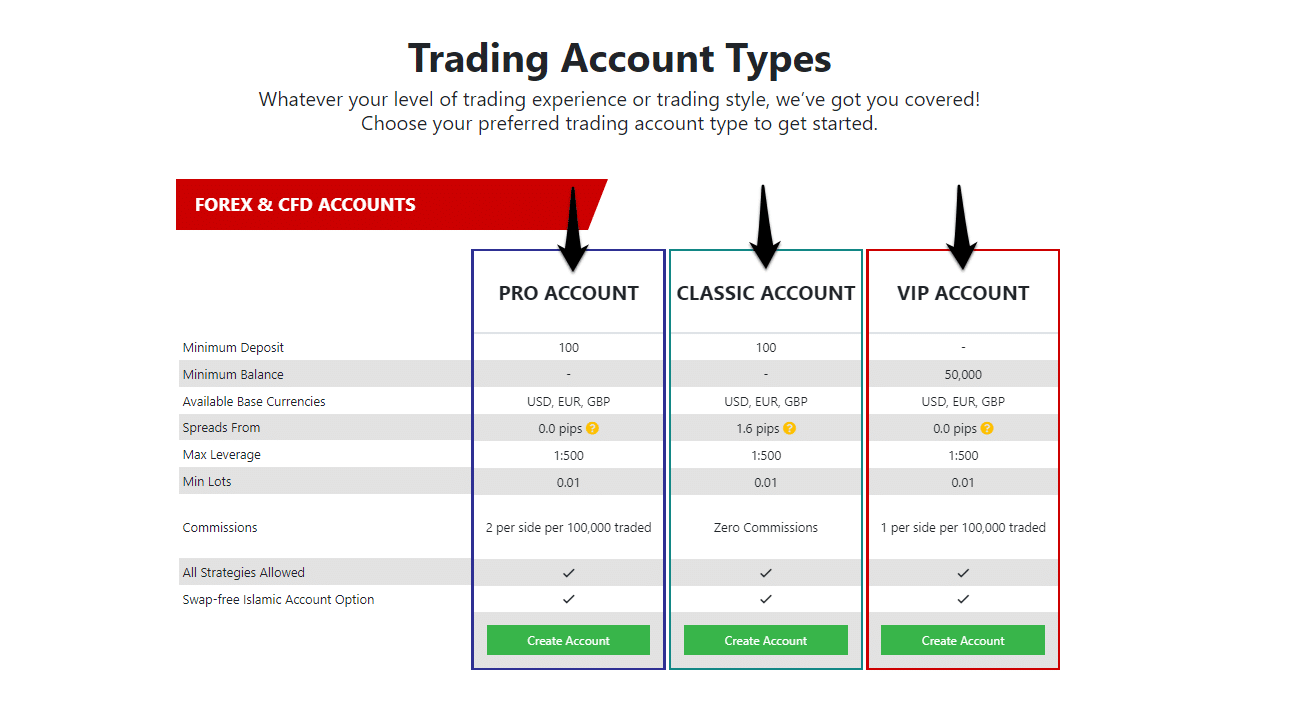

TickMill Account Types

The platform boasts three types of accounts, catering to traders with different experience levels. Whether you are a beginner or an experienced trader, you can find the account type that suits your needs. Let’s take a look at them:

Register for Account

Simply sign up online for a TickMill account.

Verify Your Account

Upload the required documents to verify your identity.

Make a Secure Deposit

Fund your account using TickMill's flexible payment options.

You’re Ready to Trade

Connect to your trading account and start investing in global markets.

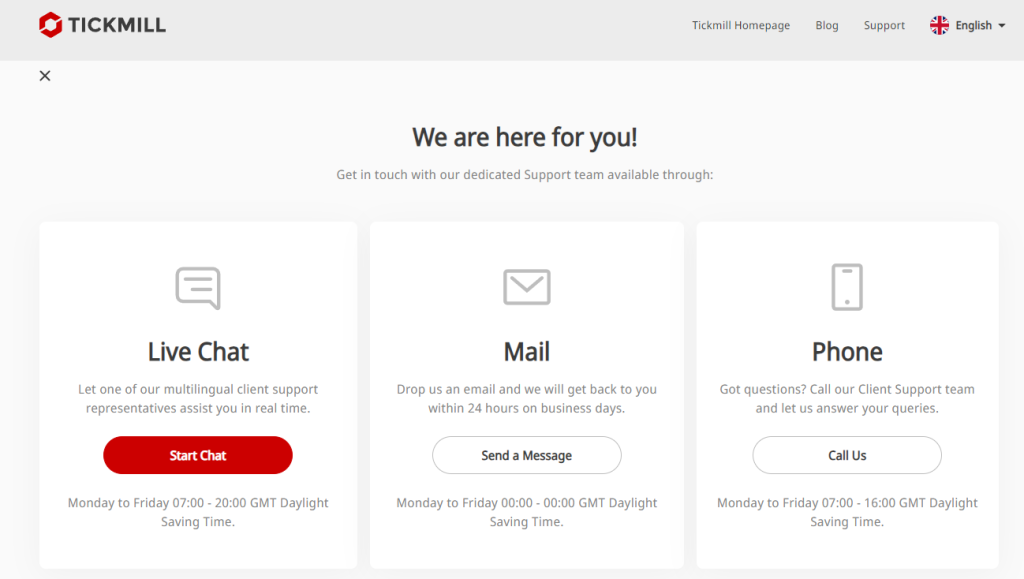

Customer Service

This broker offers excellent customer service, available anytime, anywhere. Besides live chat, you can also reach them via:

TickMill Pros & Cons

Pros:

Established in 2014, Tickmill operates under regulations from two Tier-1 jurisdictions, two Tier-2 jurisdictions, and one Tier-4 jurisdiction, ensuring high standards of oversight. Tickmill’s Raw account boasts highly competitive pricing, earning the broker recognition as the recipient of our 2024 Annual Award for #1 Commissions and Fees. The broker offers the complete MetaTrader suite, including platform add-ons, and was awarded Best in Class for MetaTrader in our 2024 Annual Awards. For futures and options trading, Tickmill provides the CQG and AgenaTrader platforms, requiring a $1,000 deposit. Tickmill is an excellent choice for professional trading and algo trading. The broker provides educational resources from the CME, along with interactive sentiment data and website widgets from Acuity Trading, enhancing research capabilities. Tickmill’s copy trading options include Tickmill Social (powered by Pelican Trading) and ZuluTrade. Automated trading is available through Capitalise, and Signal Centre (powered by Acuity) delivers trading signals and research for traders.

Cons:

Although Tickmill has expanded its range of markets recently, it still offers a limited selection of tradeable assets compared to leading forex brokers in our Offering of Investments category. Pricing for Tickmill’s Classic account is less competitive, and the removal of its VIP account may disappoint active traders seeking deeper commission savings. The TradingView platform has been discontinued for futures and options trading at Tickmill.

Is Tickmill safe?

Tickmill holds a notable Trust Score of 86 out of 99, affirming its status as a trusted entity. It’s not publicly traded nor does it operate as a bank. Authorized by two Tier-1 regulators, including the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), Tickmill’s credibility is reinforced. Additionally, it operates under the regulatory framework of the European Union via the MiFID passporting system. While also regulated by a Tier-2 regulator and a Tier-4 regulator, Tickmill maintains its reputation for reliability in the financial industry.

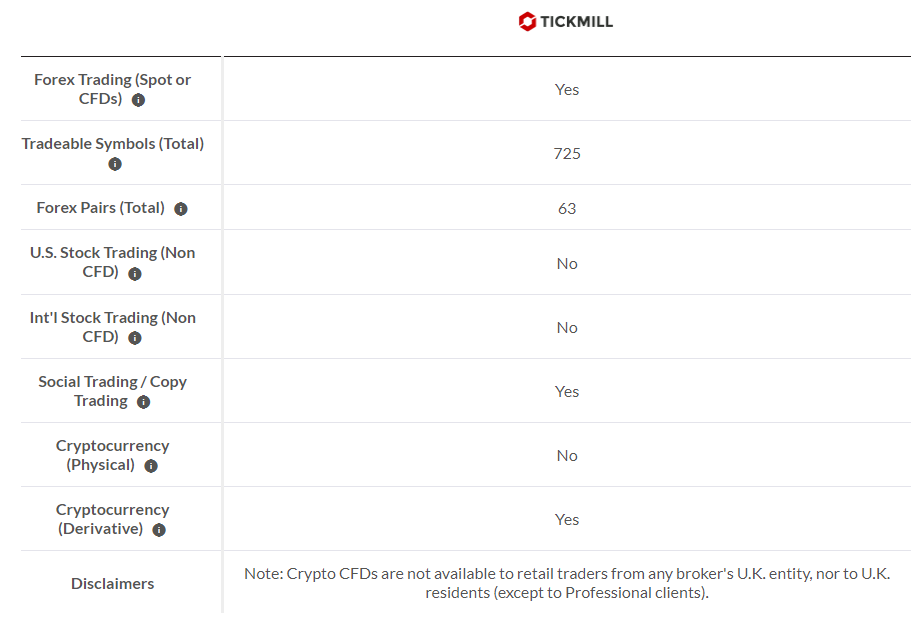

Offering of investments

Tickmill presents a diverse array of tradable symbols, totaling 725 across various categories. This encompasses CFDs on 61 currency pairs, 18 indices, 8 metals, 4 bonds, 7 commodities (including energies and agricultural products), and nine cryptocurrencies. Moreover, there are at least 109 symbols accessible for futures and options trading, all facilitated through a dedicated account. It’s important to note that cryptocurrency trading at Tickmill is conducted via CFDs and doesn’t involve trading the underlying assets directly, such as purchasing Bitcoin. It’s worth mentioning that Crypto CFDs aren’t available to retail traders through any broker’s U.K. entity, nor to U.K. residents.

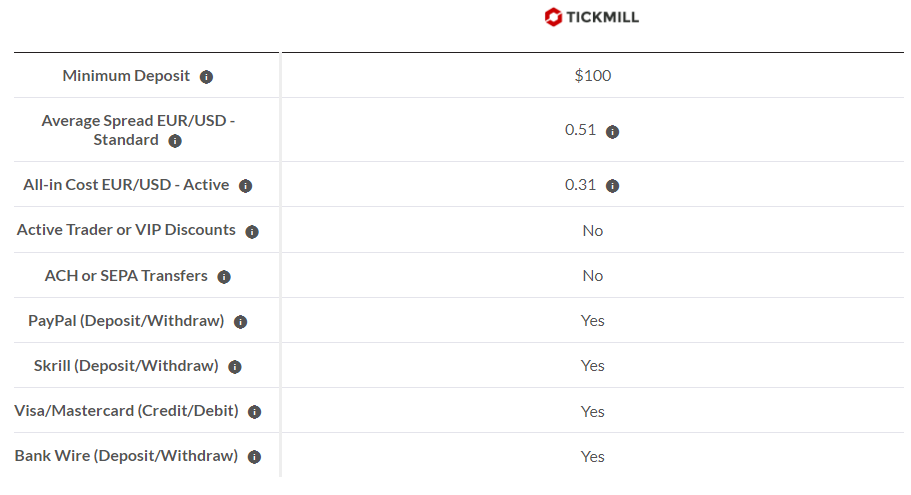

Commissions and fees

Tickmill provides two distinct account options: Classic and Raw. The Raw account, which succeeded the Pro account, now features an updated commission structure of $3 per side (up from $2 per side), equating to $6 per standard lot. Despite this recent adjustment, Tickmill remains highly regarded among active traders due to its competitive average spreads and overall cost efficiency, particularly with the new Raw account.

Classic accounts, on the other hand, are commission-free, with traders solely paying the bid/ask spread. However, it’s worth noting that the average spreads for Classic accounts are considerably higher (at 1.76 pips as of August 2023) compared to the Raw account.

Regarding spreads, Tickmill advertises a typical spread of 0.11 pips for the EUR/USD pair on its Raw (formerly Pro) account as of October 2023. However, factoring in the increased commission to $3 per side, the all-in cost now amounts to 0.71 pips. It’s important to note that Tickmill records typical spread data under normal market conditions when spreads are narrower.

The Raw account, replacing Tickmill’s Pro account and discontinuing the VIP account, offers traders access to the broker’s most competitive spreads and a per-trade commission of $3 per side per 100,000 units. With a low entry barrier set at just $100, the Raw account appeals to traders seeking cost-effective spreads and versatile execution policies, making it a preferred choice despite the recent commission adjustment.

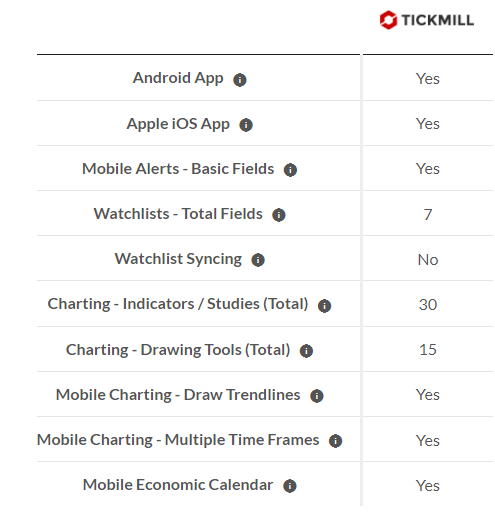

Mobile trading apps

Tickmill predominantly operates as a MetaTrader broker, offering iOS and Android versions of the MT4 and MT5 apps downloadable from the Apple App Store and Android Play Store. Alongside these, Tickmill provides specialty trading platforms for futures and options, such as CQG and AgenaTrader, catering to diverse trading needs. Additionally, Tickmill has introduced a proprietary mobile app specifically designed for account management, excluding trading functionalities. However, compared to the top-tier mobile trading apps, Tickmill’s offerings may not match the same level of competitiveness.

Market research

Tickmill showcases a competitive array of market research tools, although it falls short compared to industry giants like IG and Saxo in terms of depth, personalization, and overall quality.

In terms of research overview, Tickmill provides daily articles on its Expert Blog covering technical and fundamental analysis, complemented by video updates on its YouTube channel. Notably, its third-party research tools stand out, including the Autochartist plugin for automated technical analysis, forex news from Investing.com, and an economic calendar powered by Myfxbook. Tickmill also engages with its audience through social media platforms like Facebook groups and Telegram channels.

Tickmill offers a blend of market news and analysis, featuring articles on technical and fundamental analysis alongside series like the Weekly Live Markets & Trade Analysis, which delves into market fundamentals. Additionally, its YouTube page hosts archived webinars, technical and fundamental analysis videos, and daily Chart Hits series for quick market updates. Moreover, Tickmill provides interactive sentiment data from the CME and integrates widgets with sentiment data, along with the Signal Centre for trading signals powered by Acuity Trading.

In the realm of copy trading, Tickmill offers social copy-trading platforms like Tickmill Social powered by Pelican Trading and the AutoTrade feature of Myfxbook. However, these services are not accessible from the firm’s U.K. and EU branches.

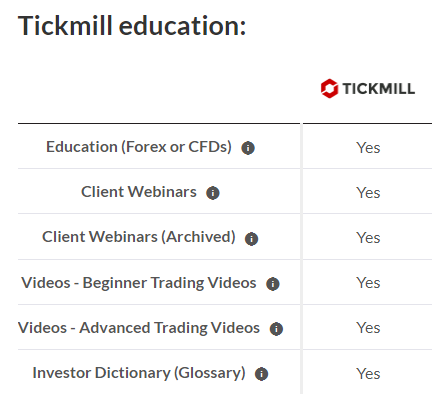

Education

Tickmill’s educational content is approaching the industry average, offering access to a considerable catalog of archived webinars. However, there’s a noticeable lack of diversity in educational articles.

The learning center comprises live educational courses, a few comprehensive eBooks, infographics, and weekly webinars available in multiple languages, archived on YouTube. Additionally, educational materials on futures, powered by the CME, are accessible on Tickmill’s website.

While Tickmill has made strides in expanding its educational resources, there’s room for improvement in both the breadth of content and variety of formats. Recently introduced series like the Masterclass, available on its YouTube channel, offer hour-long sessions covering topics for traders at all skill levels. Additionally, the Bright Minds series and the T-Show podcast provide insightful educational content. Notably, there has been an increase in written articles on its blog, indicating progress in this area.

To enhance organization, introducing a dedicated educational portal allowing content filtering by experience level would be beneficial. Moreover, features like lesson programs, quizzes, and progress tracking, commonly found at top brokers, are currently absent at Tickmill.

Final thoughts

Tickmill caters predominantly to high-volume, high-balance traders seeking to trade popular forex and CFD instruments. Its MetaTrader offering is complemented by a diverse selection of copy-trading platforms, alongside multiple account options featuring varying pricing structures.

The broker’s noteworthy achievement of earning the 2024 Annual Award for #1 Commissions & Fees is attributed to its low effective average spreads, particularly in its Raw account when factoring in per-trade commissions. Furthermore, Tickmill has been recognized with Best in Class honors for Social Copy Trading, MetaTrader, and Algo Trading in 2024.

However, it’s important to acknowledge certain drawbacks. Tickmill’s market range is relatively limited, and its research material and educational content are not as comprehensive as those offered by leading competitors. While the Raw account boasts competitive pricing, discerning traders may find that top forex brokers provide a more comprehensive suite of features beyond just low-cost trading.